To really get a handle on your operating expenses (OpEx), you need to wrap your head around one core idea: it's the sum of all the costs that keep your business running day-to-day, except for the direct costs of making whatever it is you sell.

The basic formula is OpEx = Cost of Goods Sold (COGS) + All Other Day-to-Day Expenses. This bucket includes everything from the rent on your office and salaries for your admin team to software subscriptions and your marketing budget.

Defining Your Core Business Costs

Before you start crunching numbers, you first need to get crystal clear on what actually counts as an operating expense. Think of OpEx as the money you spend just to keep the lights on and the doors open, regardless of whether you sell a single thing or a thousand units. It’s the essential overhead that supports your entire operation.

Why does this matter so much? Because these numbers directly reflect your company's profitability and efficiency. Getting them right gives you an honest, transparent look at your financial health.

Key Characteristics of Operating Expenses

Getting a feel for these traits will help you categorize costs correctly and sidestep some common accounting headaches. A cost is probably an operating expense if it checks these boxes:

- It’s an indirect cost: It isn’t tied directly to producing one specific product or delivering a single service. For instance, your office manager's salary supports the whole company, not just one sale.

- It happens in day-to-day activities: These are the recurring costs needed to keep the business humming along, like your monthly utility bills or the money you spend on a marketing campaign.

- It’s not a capital expenditure: OpEx doesn’t cover huge, one-time purchases of assets like buildings or heavy machinery. Those are capitalized and depreciated over time instead.

Getting a firm grasp on your operating expenses is the absolute foundation for improving your business's financial performance. It’s step one toward boosting profitability, managing cash flow, and making smarter strategic decisions.

To help you get started, here's a quick breakdown of the usual suspects you'll be looking for when you tally up your operating expenses.

Table: Key Components of Operating Expenses

| Expense Category | Description | Common Examples |

|---|---|---|

| Selling, General & Administrative (SG&A) | Costs related to running the business that aren't tied directly to production. | Salaries, rent, utilities, office supplies, marketing, legal fees. |

| Research & Development (R&D) | Expenses incurred in the process of creating new products or improving existing ones. | R&D staff salaries, materials for prototypes, testing equipment. |

| Depreciation & Amortization | The gradual expensing of tangible (depreciation) and intangible (amortization) assets over time. | Depreciation on equipment, amortization of patents or software. |

Once you've identified and categorized these expenses, you're well on your way to a clearer financial picture.

Ultimately, mastering this calculation is what allows you to measure and really drive your company's financial performance. For any business owner looking to grow, understanding the subtle differences between these cost types is a critical skill. To dig deeper into how this all connects, check out our guide on what is operational efficiency and the role it plays in long-term success.

Identifying and Categorizing Your Operating Costs

Before you can get a real handle on your operating expenses, you need to know exactly what you’re looking for. This means getting intimate with your financial records—bank statements, credit card bills, accounting software, the whole lot. You're building a complete picture of every dollar that keeps the lights on.

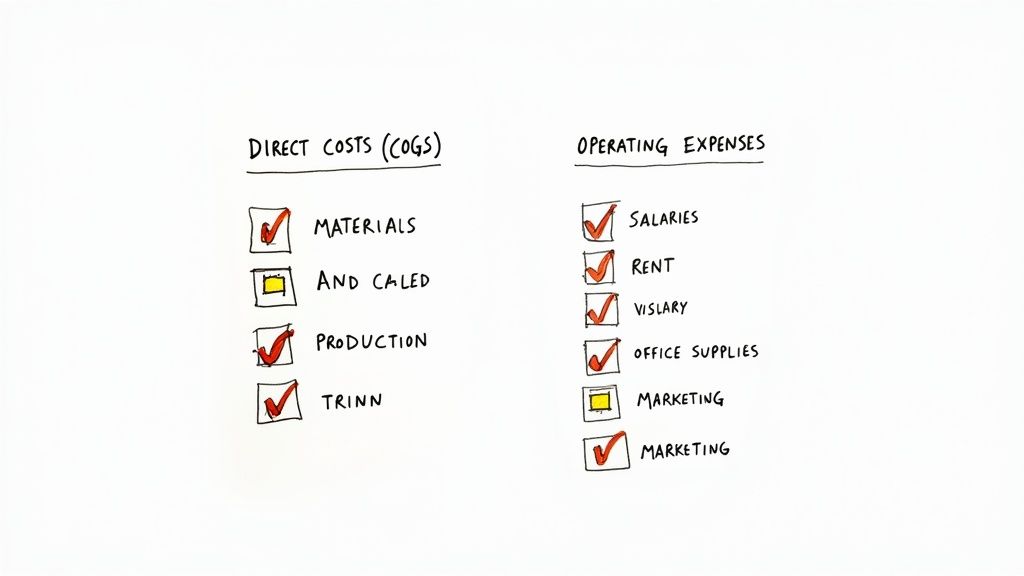

The whole point is to draw a clean line between the indirect costs of being in business and the direct costs of what you actually sell.

Think of it this way: the leather for a pair of shoes is a direct cost. The salary of the HR manager who hired the shoemaker? That’s an operating cost. Getting this distinction right is the first step toward understanding how efficient your operation really is.

Unpacking SG&A Expenses

The lion's share of your operating costs will almost always fall under one big umbrella: Selling, General, & Administrative (SG&A). This category is basically a catch-all for all the essential, day-to-day spending that isn't directly tied to producing a product or delivering a service.

Let's break down what usually gets tossed into the SG&A bucket:

- Selling Costs: This is everything you spend to actually make a sale. We're talking sales team salaries, commissions, those Google ad campaigns, and your marketing software subscriptions.

- General Costs: These are the foundational expenses of just having a place to work. Think rent for your office or storefront, utilities, printer paper, and property insurance.

- Administrative Costs: This bucket is for the salaries of all the non-production folks—HR, accounting, executive leadership—plus things like legal fees and bank charges.

Once you start pulling these costs apart, you'll immediately see where you might be overspending. If you're looking for some smart ways to trim the fat, our guide on how to reduce business expenses is packed with tips you can use right away.

Beyond the Usual Suspects

While SG&A covers a ton of ground, it’s not the whole story. Other operating expenses can fly under the radar but add up fast if you’re not tracking them carefully.

For any business trying to innovate, research and development (R&D) is a huge one. For companies with a fleet, vehicle costs—fuel, maintenance, insurance—are a massive operating expense. It's not just about tracking fuel, either; finding ways to boost semi-truck fuel economy can shave a significant amount off your bottom line.

The real power in this process isn't just listing costs—it's understanding them. By categorizing every dollar, you can see exactly where your money is going and make smarter, data-driven decisions about your budget.

This method of categorizing expenses is fundamental, even for massive global organizations. Take workforce costs, which are often the single largest line item. The Global Fund, in its 2025 budget planning, noted that 59% of its $1.025 billion three-year operating expense budget was earmarked for workforce expenses like salaries and insurance. You can dig into their full budget report to see exactly how a major organization structures its operational spending.

Applying the OpEx Formula with Real-World Scenarios

Understanding the theory behind OpEx is one thing, but applying it to a real balance sheet is where clarity truly begins. Let's move beyond definitions and walk through two distinct business models to see how operating expenses shake out in practice.

The goal isn't just to add up numbers; it's to see the story they tell about a business. We'll start with a service-based company, where the lines between COGS and OpEx can sometimes feel a bit blurry.

Scenario One: A Digital Marketing Agency

Imagine a small digital marketing agency, "Pixel Perfect," operating out of a leased office space. Their revenue comes from client retainers for things like SEO, social media management, and pay-per-click advertising. Since they don't sell a physical product, their Cost of Goods Sold is minimal, mostly just contractor fees for specialized freelance work on client projects.

Here’s a snapshot of their typical monthly operating expenses:

- Rent for Office Space: $3,500

- Utilities (Internet, Electricity): $450

- Software Subscriptions (SEO tools, CRM, project management): $800

- Administrative Salaries (Office Manager, Accountant): $8,000

- Marketing & Advertising (Their own ad spend): $2,000

- Insurance: $300

- Office Supplies: $150

To calculate their monthly OpEx, we just sum these costs:

$3,500 + $450 + $800 + $8,000 + $2,000 + $300 + $150 = $15,200

This figure, $15,200, represents the baseline cost for Pixel Perfect to keep its doors open for one month, regardless of how many clients they're juggling. Knowing this number inside and out is crucial for pricing their services and determining if their spending is actually paying off. For a deeper dive, our article on https://www.marlie.ai/blog/how-to-calculate-roi can add some valuable context here.

Scenario Two: An E-Commerce Brand

Now let's switch gears to "Crafted Goods," a small e-commerce business that designs and sells handmade leather wallets. For a product-based company like this, cleanly separating COGS from OpEx is absolutely essential for an accurate read on profitability.

Their COGS includes the direct costs of creating each wallet—the leather, the thread, and the wages of the craftspeople who assemble them.

Their operating expenses, on the other hand, are all the costs to run the business side of things:

- Warehouse Lease: $2,500

- E-commerce Platform Fees: $350

- Sales & Marketing Salaries: $6,000

- Online Advertising Spend: $4,000

- Office Staff Salaries (Admin, Support): $5,500

- Business Insurance: $500

- Packaging Supplies (Boxes, tape, labels – not part of the product itself): $700

The total monthly OpEx for Crafted Goods comes out to:

$2,500 + $350 + $6,000 + $4,000 + $5,500 + $500 + $700 = $19,550

Notice how things like factory overhead and sales commissions are kept separate from direct production costs. This distinction is what helps them accurately assess their gross margin on each wallet sold versus the overall operational efficiency of the business.

In the real world, calculating specific operating costs can get tricky. For example, to accurately determine the true cost of an employee, which includes not just salary but also benefits and taxes, you'll probably want to use a dedicated calculator.

Using Your Operating Expense Ratio for Deeper Insights

Tallying up your operating expenses is just the first step. You're left with a number, but what does it actually tell you? On its own, not much. The real magic happens when you put that figure into context to get a clear picture of your company's operational health.

This is where the Operating Expense Ratio (OER) comes in. It’s a simple but incredibly powerful tool.

The OER turns your raw OpEx figure into a vital key performance indicator (KPI). It shows you, in plain terms, exactly how much you spend to generate every single dollar of revenue. Think of it as your North Star for measuring how lean and efficient your operation truly is.

Calculating Your Operating Expense Ratio

The formula itself is dead simple, but the clarity it offers is profound. It directly ties your spending to your revenue, giving you a tangible efficiency score.

Here's the math:

OER = (Total Operating Expenses / Total Revenue) x 100

Let's say your business had $50,000 in operating expenses last quarter and brought in $200,000 in revenue. Your OER would be 25%. In other words, for every dollar you earned, you spent 25 cents to keep the lights on and the business running.

This is just one of many key performance indicators for small business success, but it's one of the most fundamental.

A lower OER is almost always a sign of stronger operational efficiency. It’s a direct reflection of your ability to keep costs in check while growing the top line. The goal isn't just to make money—it's to keep as much of it as possible.

Tracking this ratio over time transforms a static expense calculation into a dynamic tool you can use to make smarter, more strategic decisions.

How to Use Your OER for Strategic Decisions

Once you have your OER, its real value comes from comparison. A single OER number is just a snapshot; the trendline is the movie.

Here are a few ways to put your OER to work:

- Benchmark Against Your Past Self: Is your OER creeping up month over month? Or is it trending down? A rising ratio can be an early warning sign of bloated costs or hidden inefficiencies that need to be tackled before they eat into your profits.

- Compare to Industry Averages: How does your efficiency stack up against the competition? If your OER is way higher than the norm for your industry, it's a clear signal to dig into your expenses and find out where you might be overspending.

- Inform Better Budgeting and Forecasting: Your historical OER is a fantastic tool for building more realistic budgets. If you’re projecting a certain amount of revenue growth, you can use your OER to get a pretty accurate estimate of the operating costs required to support it.

This ratio isn't just for small businesses; it's a critical health metric for companies of all sizes. Even at a massive scale, the relationship between expenses and revenue is under constant scrutiny. For example, in Q3 2024, large U.S. investment-grade companies saw operating expenses climb to $3.052 trillion. Yet, the overall expense-to-revenue ratio actually trended lower, signaling that revenue growth was outpacing cost increases in some sectors.

Common Mistakes to Avoid When Calculating OpEx

Getting your financial calculations right isn't just about good bookkeeping—it's non-negotiable for the health of your business. I've seen it time and again: small, seemingly innocent errors in calculating operating expenses can send you down a completely wrong path. They lead to flawed budgets and misguided strategies, and these problems only get bigger over time.

Think of this as a quick rundown of the most common traps business owners fall into. More importantly, let’s talk about how you can sidestep them.

Getting this right means your financial reports are a true reflection of reality. That’s the only solid ground you can stand on to make genuinely smart decisions for your company's future.

Misclassifying COGS as OpEx

This is probably the most frequent mistake I see. It's so easy to blur the line between the Cost of Goods Sold (COGS) and your operating expenses, but they are fundamentally different.

COGS covers only the direct costs tied to creating your product or service. Everything else—all the indirect costs that keep the lights on and the business running—falls under OpEx.

Here’s a simple way to think about it: the salary of the person on the assembly line is COGS. But the salary of the HR manager who hired that person? That's OpEx. When you mix them up, you completely distort your gross margin and operating margin, which gives you a warped view of your company's actual profitability.

A clean separation between COGS and OpEx is fundamental. It allows you to accurately assess your production efficiency separately from your overall operational efficiency, which are two very different things.

The best fix here is preventative. Standardize your chart of accounts from day one. Create crystal-clear categories for direct production costs versus your general, administrative, and selling expenses. This one organizational step enforces consistency and cuts down the risk of misclassification dramatically.

Forgetting the Hidden Costs

It's easy to remember the big stuff like rent checks and payroll. But it's the smaller, less obvious expenses that often slip through the cracks and quietly throw your numbers off. Trust me, these "hidden" costs add up faster than you think.

You have to make sure you're accounting for things like:

- Bank fees and credit card processing charges: These might seem small, but they are a direct cost of doing business and absolutely belong in your OpEx calculation.

- Depreciation and amortization: These are non-cash expenses, but they are very real. They reflect the declining value of your assets and must be included.

- Business licenses and permits: Those annual renewal fees are a classic operating cost. They're also classic "out of sight, out of mind" expenses until the bill shows up.

The best defense here is a good offense. Make it a habit to regularly review your bank and credit card statements line by line. Hunt for those recurring charges you haven't categorized yet. Modern accounting software is also a huge help, as it can automate the tracking of these smaller items so nothing gets missed.

Streamlining your operations can also bring these costs to light. For more on that, check out our guide on how to reduce overhead costs.

Using Inconsistent Tracking Periods

If you compare your OpEx from a five-week month to a four-week month without any adjustment, you’re not getting a clear picture. You're setting yourself up to see trends that aren't really there. For analysis to be meaningful, consistency is everything.

Always calculate and compare your operating expenses over standardized periods—monthly, quarterly, and annually. This is the only way to get a true apples-to-apples comparison.

This simple discipline helps you spot genuine spending spikes or savings, instead of chasing ghosts caused by the quirks of the calendar. It makes your financial analysis reliable, and more importantly, actionable.

Diving Deeper: Common Questions About Operating Expenses

Once you start calculating operating expenses, a few questions almost always bubble to the surface. It's one thing to know the formula, but it's another to apply it confidently in the real world.

Let's clear up some of the most common points of confusion. Getting these distinctions right is key to keeping your financial reports clean and accurate.

What's the Difference Between Operating Expenses and Capital Expenditures?

This is a big one, and it trips up a lot of people. The core difference boils down to timing and purpose.

Operating expenses (OpEx) are the costs of keeping the lights on right now. Think rent, salaries, utilities, and marketing spend. These are the day-to-day costs that are fully tax-deductible in the same year you pay them. OpEx is all about funding your current operations.

Capital expenditures (CapEx), on the other hand, are major purchases of assets that will provide value for years to come. We're talking about buying a building, a new delivery truck, or heavy machinery. Instead of deducting the entire cost at once, CapEx is depreciated over the asset's useful life. This is an investment in your company's future growth.

The simplest way to think about it is: OpEx is for running the business day-to-day, while CapEx is for growing the business for the long haul.

Should Interest and Taxes Go into My Operating Expenses?

Nope. That's a hard no. Interest and taxes are both considered non-operating expenses.

Why the strict separation? Because neither of these costs has anything to do with your core business activities. They don't reflect how efficiently you're making your product or serving your customers.

- Interest Expense is a financing cost. It’s a reflection of how you've structured your company's debt, not a measure of your operational performance.

- Taxes are what you owe the government based on your profitability. They are calculated after you've figured out how well your core business is doing.

If you look at a standard income statement, you'll see that you get to operating income (often called EBIT, or Earnings Before Interest and Taxes) by subtracting COGS and operating expenses from your revenue. Only after that do you subtract interest and taxes. This separation gives you a much clearer picture of your company's true operational health.

How Often Should I Calculate Operating Expenses?

For any kind of meaningful financial control, you need to be calculating and reviewing your operating expenses at least monthly.

Doing this every month isn't just about bookkeeping. It's about having a real-time pulse on your business. A monthly review helps you:

- Spot trends quickly. You can catch unusual spending spikes or find new cost-saving opportunities before they spiral out of control.

- Generate accurate reports. Monthly income statements and other financial reports depend on these regular calculations to be reliable.

- Make smarter decisions. With fresh data in hand, you can make fast, informed adjustments to your budget and overall strategy.

While a monthly check-in is crucial for active management, you’ll also want to look at your OpEx on a quarterly and annual basis. This wider view is essential for spotting long-term patterns and making sure you're on track to hit your bigger financial goals for the year.

Are routine phone calls slowing your team down? Marlie Ai is a 24/7 AI phone assistant that handles scheduling, answers FAQs, and captures lead details so you can focus on revenue-generating work. Stop missing calls and start saving time and money. Learn more about Marlie Ai.