Alright, let's trim the fat. Reducing your business's recurring expenses—things like rent, utilities, and administrative salaries—really boils down to three things: amping up your operational efficiency, getting smarter with your technology, and being strategic about your spending reviews. The first step, though, is always the same: you have to know exactly where your money is going.

Your Guide to Slashing Overhead Costs

Overhead is all the stuff you have to pay for just to keep the lights on. It’s not the direct cost of delivering a service to a client, but it’s everything humming in the background that makes your business possible. Think of it as the financial engine of your company.

Too many business owners just write these costs off as fixed, unavoidable parts of doing business. That’s a massive missed opportunity. Figuring out how to reduce overhead isn't about painful, service-killing cuts. It’s about sniffing out and eliminating waste. And that whole process starts with a clear diagnosis of your spending.

Categorizing Your Overhead for Clarity

The first real move is to sort every single expense into a category. This isn't just a bookkeeping chore; it's a strategic deep dive that reveals where your cash is actually flowing. Once you start grouping expenses, patterns jump out at you, and you can see which areas have the most fat to trim.

To get you started, here's a quick way to think about and categorize your common overhead costs.

Quick Guide to Overhead Cost Categories

This table categorizes common overhead expenses to help you quickly identify and classify your own business costs.

| Category | Examples |

|---|---|

| Fixed Costs | Office rent, insurance premiums, salaried admin staff, loan payments, annual software subscriptions. |

| Variable Costs | Office supplies, marketing campaign spending, hourly contractors, sales commissions, some utilities (e.g., electricity based on usage). |

| Semi-Variable Costs | Phone plans (base rate + data overages), sales salaries (base + commission), vehicle leases (base fee + mileage charges). |

Getting this initial breakdown right is crucial. It moves you from a vague sense of "we spend too much" to a clear picture of exactly where the leaks are.

The Real Impact of Hidden Expenses

Unchecked overhead is insidious. It slowly eats away at your profit margins, often without you even realizing it. It’s the classic "death by a thousand cuts" scenario—that forgotten software subscription, that inefficient process that wastes five hours a week. These tiny leaks add up to a huge drain on your resources over a year.

This isn't just a small business problem, either. It affects companies of all sizes. For instance, global organizations constantly battle overhead bloat. One healthcare company managed to deliver $1 billion in savings by ruthlessly tackling the four main drivers of overhead: administrative complexity, inefficient processes, rigid team structures, and outdated tech. You can dig into the specifics in this BCG research on organizational cost challenges.

This is exactly why a proactive approach is non-negotiable. When you understand the true impact of these costs, you can start turning those hidden expenses into visible savings and build a much stronger financial foundation for your business.

Key Takeaway: Don't wait for a cash flow crunch to scrutinize your overhead. Regular, proactive reviews flip cost-cutting from a reactive chore into a strategic advantage, making your business more resilient and agile.

This shift in mindset is everything. Stop seeing overhead as a burden and start seeing it as an opportunity for optimization that can directly fuel your growth and long-term stability.

Streamline Operations with Automation

One of the most powerful ways to cut overhead is to take a hard look at your internal processes. Inefficient workflows are silent profit killers. They quietly add up to hundreds of wasted hours and administrative mistakes over a year. By identifying and fixing these operational weak spots, you can unlock significant savings without cutting a single essential service.

The core idea here is to find and eliminate waste. I'm not just talking about physical materials; I'm talking about wasted time, redundant steps, and repetitive tasks that drain your team's energy and your bottom line.

Map Your Workflows to Find Bottlenecks

You can't fix a problem until you can see it clearly. This starts with mapping out your most common business processes from beginning to end. Don't overthink it—this doesn't need to be some complex, color-coded diagram. A simple flowchart on a whiteboard or a quick digital document gets the job done.

For a service business, you might map out processes like:

- New Client Onboarding: From that first inquiry call all the way to a signed contract and project kickoff.

- Job Scheduling & Dispatch: How a service request actually turns into a technician being sent to a location.

- Invoicing & Collections: The entire journey from finishing a job to getting paid.

As you walk through each step, ask the hard questions. Where do things slow down? Which tasks require someone to manually type the same information into three different systems? Where do communication breakdowns usually happen? These points of friction are your prime targets for improvement.

For any service business, just understanding these steps is the first move toward a leaner, more profitable operation. We take a much deeper look at this in our guide on business process improvement methods.

Automate Repetitive Administrative Tasks

Once you’ve got your bottlenecks pinpointed, automation is the next logical step. This is where you can make a massive dent in your overhead costs. Repetitive, low-value administrative work is a huge source of hidden expenses, eating up employee time that should be spent on billable client work or growing the business.

Think about a small marketing agency. Their team might be spending several hours every single week just manually scheduling client meetings, sending follow-up emails, and creating invoices. Every one of those tasks is a perfect candidate for automation.

Real-World Scenario: A plumbing company I know used to have their lead technician spend the first hour of every day listening to overnight voicemails and manually scheduling emergency calls. They brought in an AI phone assistant, Marlie.ai, to handle it. Suddenly, all incoming calls were answered, details were collected, and urgent jobs were automatically added to the schedule. This one change saved 5-7 hours per week of a highly-paid technician's time, freeing him up for billable work and immediately boosting profitability.

This is the real power of automation for a small business. It isn't about complex factory robots; it’s about using smart, accessible software to handle the simple, rules-based tasks that clog up your day.

Practical Automation Opportunities for Service Businesses

Think about the daily and weekly tasks that eat up the most admin time in your business. You'd be surprised how many there are. Here are some of the most common areas where automation can deliver an immediate return:

- Appointment Scheduling: Stop the back-and-forth emails. Use tools that let clients book directly into your calendar based on your real-time availability.

- Customer Inquiries: An AI phone assistant can answer calls 24/7, qualify leads, and provide basic info so you never miss a potential customer.

- Invoicing and Payments: Automate your invoice creation and send out payment reminders. This drastically improves cash flow and cuts down on awkward follow-up calls.

- Data Entry: Connect your apps. When a new client fills out a form, that information should automatically populate your CRM and your accounting software without anyone touching a keyboard.

By offloading these tasks to technology, you're not just cutting down on paid admin hours. You're also making your business faster and more responsive. That efficiency becomes a powerful competitive advantage that also makes your customers happier.

Ditch the Office Lease and Embrace Flexible Work

For ages, a physical office space was one of the most stubborn and significant line items on any service business's budget. Having that commercial lease felt like a non-negotiable cost of being legitimate. But that assumption is completely falling apart, giving smart business owners a huge opportunity to rethink their entire structure and slash overhead.

This isn't about following a trend. Moving away from the traditional, office-first model is a core financial strategy. You can unlock the capital previously sunk into rent, utilities, and office furniture and pour it back into things that actually grow your business.

The Real Financial Win of Going Remote

One of the most powerful ways to cut overhead costs is by embracing flexible work models, whether that's fully remote or a hybrid setup. Since 2020, businesses everywhere have had a lightbulb moment: paying for a large, physical office all the time is often a massive waste of money. A 2023 analysis showed that companies shifting to hybrid work models saw dramatic cuts in overhead, especially on rent and utilities.

The savings are direct and easy to measure. Just think about the expenses you either eliminate or shrink dramatically:

- Monthly Rent: The biggest and most obvious win.

- Utilities: Your bills for electricity, heat, AC, and internet either vanish or get much smaller.

- Office Supplies and Furniture: Say goodbye to bulk orders of paper, printer toner, and desks.

- Insurance: Your liability insurance costs can drop when you have a smaller physical footprint.

When you add it all up, the financial benefit becomes crystal clear. For a small service business, this can easily mean saving thousands upon thousands of dollars every year. For a deeper dive into how these strategies can set you up for success, you can explore more insights on cost reduction for 2025 and beyond.

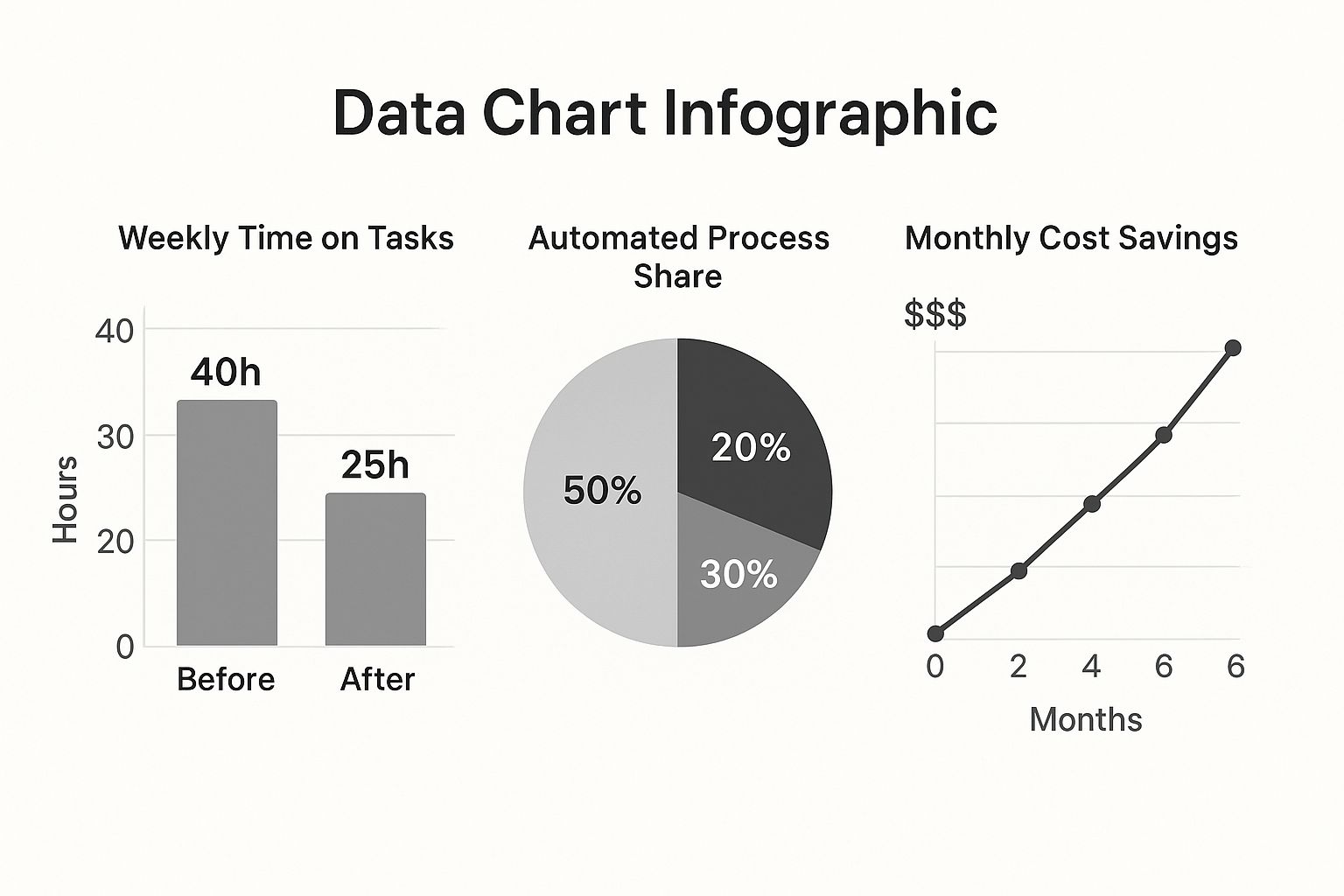

The following image illustrates just how much these kinds of process improvements—often enabled by the technology that supports remote work—can compound over time.

As the data shows, streamlining how you work cuts down on weekly hours, while automation takes over more tasks. The result? Monthly savings that keep growing.

Swap On-Premise Headaches for Cloud Agility

Another classic overhead trap is traditional, on-premise IT. Buying, housing, and maintaining your own servers is a serious capital expense, not to mention the ongoing costs for electricity, cooling, and the specialized IT support to keep it all running. It's a rigid and expensive model that's hard to scale.

Cloud computing flips that model on its head. Services like Amazon Web Services (AWS) or Microsoft Azure let you trade that huge upfront investment for a flexible, pay-as-you-go operational expense. You only pay for the storage and computing power you actually use, which is a total game-changer for businesses whose needs change throughout the year.

The cost difference becomes obvious when you put the two approaches side-by-side.

On-Premise IT vs. Cloud Computing Cost Comparison

This table breaks down the clear cost advantages of moving away from traditional on-premise servers and embracing cloud-based services.

| Cost Factor | On-Premise IT | Cloud Computing |

|---|---|---|

| Initial Investment | High (servers, hardware, software licenses) | Low to none (pay-as-you-go model) |

| Maintenance | Ongoing (staff, parts, repairs, security) | Managed by the provider |

| Energy & Cooling | Significant electricity costs for servers | Included in the service fee |

| Scalability | Slow and expensive (requires purchasing new hardware) | Instant and flexible (adjust resources on demand) |

| Upgrades | Requires manual hardware and software updates | Handled automatically by the provider |

Moving to the cloud isn't just about cutting direct costs; it's about gaining security and agility. Your business can adapt on the fly without being held back by clunky, outdated hardware.

Must-Have Tools for a Distributed Team

Making the jump to a flexible work model only works if you have the right digital tools in your arsenal. These cloud-based platforms essentially become your new office, allowing your team to communicate and collaborate from anywhere.

For any service-based business, these are the non-negotiables:

- Communication Hubs: Think of platforms like Slack or Microsoft Teams as your virtual headquarters. They keep everyone in sync with instant messaging, organized channels, and video calls.

- Productivity Suites: You still need the basics. Google Workspace or Microsoft 365 provide the essential apps—email, documents, spreadsheets, and shared calendars—that keep the business running.

- Project Management Software: To make sure nothing falls through the cracks, you need a tool like Trello, Asana, or Monday.com. They keep tasks on track, deadlines in sight, and everyone clear on their responsibilities.

By carefully choosing and implementing these technologies, you can not only maintain productivity but often improve it, all while cashing in on the huge overhead savings that come with a more flexible way of working.

Review Spending and Vendor Relationships

Some of the biggest wins in cutting overhead are hiding in plain sight—buried deep within the financial reports you're already generating. The secret is learning how to do a proper financial deep dive, a skill that pays for itself almost immediately.

This isn't just about a quick glance at your P&L statement. It’s about putting every single recurring charge under the microscope. Your software subscriptions, insurance premiums, office supply orders, professional retainers… every dollar has to earn its keep. It’s amazing how these costs can creep up, almost silently, until they become a serious drain on your cash flow.

Uncover and Eliminate 'Subscription Creep'

One of the most common culprits I see bloating a company's overhead is subscription creep. It's the slow, steady accumulation of software licenses, online tools, and other recurring fees that are no longer essential. It happens to the best of us. You sign up for a tool to tackle a specific project, the project wraps up, but the monthly billing just keeps on going.

The best way to fight this is with a simple audit. Fire up a spreadsheet and list out every single subscription. All you need are three columns:

- Service Name: What's the tool?

- Cost: What are you paying, monthly or annually?

- Justification: Is this absolutely critical? Ask yourself, "If we lost access to this tomorrow, would it stop a core part of our business?"

Be honest. Be ruthless. If a tool gets used once in a blue moon, or if its main function can be handled by another piece of software you're already paying for, it's on the chopping block. This exercise alone can often free up hundreds, if not thousands, of dollars per year.

The Power of Consolidation

Once you have a clear picture of what you're using, start looking for overlap. Are you paying for separate tools for project management, team chat, and file sharing? You might find it’s far more cost-effective to switch to an all-in-one platform like Google Workspace or Microsoft 365.

This same logic extends to your suppliers. Buying office supplies from three different vendors means you’re probably missing out on bulk discounts and paying way more than you need to in shipping. Consolidating your orders with a single, go-to vendor not only saves money but also gives you more leverage in negotiations and simplifies your whole procurement process.

Key Takeaway: Every vendor relationship is a negotiation. If you aren't periodically reviewing your contracts and checking out what competitors are offering, you're almost certainly leaving money on the table.

This is a crucial mindset shift. Your vendors want to keep your business, and that gives you power. A little research and a thoughtful conversation can dramatically lower your costs without compromising on the quality you need.

Master the Art of Vendor Renegotiation

With a clear understanding of your spending, you’re ready to start renegotiating contracts. I know this can feel a bit awkward, but it's a completely normal and expected part of doing business. A few practical tactics can make all the difference.

First, do your homework. Before calling your insurance provider, get quotes from at least two of their competitors. Knowing the market rate for the same coverage is your single most powerful tool. When you can say, "I have an offer from Competitor X for this price," your current provider has a very strong incentive to match it.

Next, get creative with payment and service terms. Ask your vendors about things like:

- Annual vs. Monthly Payments: Many software companies will give you a significant discount, often 10-20%, for paying a year upfront.

- Bulk Purchase Discounts: If you’re a consistent customer, ask for a better rate based on your volume.

- Service Level Adjustments: Look through your contracts for features you pay for but never actually use. Maybe your business phone plan includes international calling you don’t need.

Finally, don't be afraid to just ask for a better deal. A polite, direct conversation can work wonders. Explain that you're doing a company-wide review to how to reduce business expenses and want to see if there’s a more favorable rate available. The worst they can say is no, and the potential savings are well worth the ask.

Use Smart Staffing and Outsourcing to Your Advantage

Your team is your single greatest asset, but let's be honest—payroll is almost always the monster expense eating up your budget. The real trick is figuring out how to cut those overhead costs without crushing team morale or, even worse, letting the quality of your work suffer.

The answer isn't about across-the-board cuts. It's about building an agile, flexible workforce that can scale up or down with your actual business needs, not just your fixed costs. This means shifting away from the old-school thinking that every single function demands a full-time hire. You can build a much leaner, more powerful team by blending core employees with on-demand experts. This approach gives you access to specialized skills exactly when you need them, letting you dodge the hefty price tag of a permanent salary, benefits, and training for roles that aren't central to your day-to-day grind.

Outsource Non-Core Functions for a Shot of Expertise

Take a good, hard look at everything your business does. Which tasks are directly tied to delivering your core service, and which ones are just keeping the lights on? Things like bookkeeping, IT support, or even very specific marketing campaigns are often perfect candidates for outsourcing.

When you bring in a freelancer or a specialized agency for these roles, you get two massive wins:

- Instant Expertise: You get top-tier professional work from people who live and breathe that specific field. You're tapping into a level of skill you probably couldn't afford in a full-time hire.

- Cost-Efficiency: You only pay for the work you actually need. Maybe it's a few hours a month for bookkeeping or a one-time project for a website redesign. This flips a fixed payroll cost into a predictable, variable expense you can control.

Here's a real-world example: I worked with a growing HVAC company that was completely stuck on marketing. They were thinking about hiring a full-time marketing manager, which meant a commitment of at least $60,000 a year plus benefits. Instead, they outsourced to a digital marketing agency for $1,500 a month. Overnight, they got access to an entire team of specialists—a copywriter, a paid ads expert, and an SEO analyst—for a fraction of what one in-house generalist would have cost them.

This kind of strategic move is a cornerstone of reducing overhead effectively. It’s not about cutting corners; it’s about paying for incredible results without the long-term burden of another full-time employee.

Contractors vs. Employees: The Strategic Difference

Getting a handle on the difference between an independent contractor and an employee is absolutely critical for building a lean team. While your employees are the backbone of your daily operations, contractors offer flexibility and specialized skills for specific, often temporary, projects.

Choosing the right one comes down to the nature of the work.

| Consideration | Independent Contractor | Full-Time Employee |

|---|---|---|

| Work Type | Project-based, specialized tasks (e.g., legal advice, graphic design) | Ongoing, core business functions (e.g., daily operations, customer service) |

| Cost Structure | Pay per project or hour; no benefits or payroll taxes | Fixed salary, benefits, insurance, payroll taxes, training costs |

| Flexibility | High; easily scale up or down based on project needs | Low; hiring and firing processes are complex and costly |

| Integration | Lower; focused on specific deliverables | High; deeply integrated into company culture and long-term strategy |

The goal here is to strike the right balance. You rely on employees for the essential, day-to-day work that is your company. Then, you build a network of trusted contractors to handle everything else. This hybrid model gives you a stable core with the agility to pivot and adapt to any project or economic shift, all without getting bogged down by a bloated payroll.

If you want to go deeper on managing this major expense, we've got a whole guide on how to reduce payroll costs that breaks down even more strategies.

Common Questions About Reducing Overhead

Even with a clear strategy, digging into your business finances can bring up some tough, practical questions. It's only natural. Knowing the answers ahead of time helps you cut costs with confidence and sidestep the common pitfalls that trip up other owners.

Below, we’ll tackle the real-world questions that always seem to pop up once you start the journey of reducing overhead. These are the queries we hear most often from business owners who are serious about getting lean and boosting their bottom line.

What Is the Very First Thing I Should Do to Reduce Overhead?

Before you do anything else, you need to do a thorough expense audit. It's simple, really: you can't cut what you can't see.

Your mission is to gather all your financial statements from the last 6-12 months and categorize every single expense. Is it a "direct cost" (like materials for a specific job) or "overhead" (like your phone bill)?

Once you've separated out the overhead, get even more specific. Break it down into clear subcategories like rent, software subscriptions, insurance, and vehicle maintenance. Running these reports in your accounting software gives you a data-backed map of where every dollar is going. This immediately shines a light on the biggest targets for reduction.

Without this initial analysis, any attempt to cut costs is just a shot in the dark. This foundational work transforms your approach from guessing to a targeted, strategic plan.

Will Cutting Overhead Hurt the Quality of My Service?

This is a common fear, but the answer is a firm no—if you cut strategically.

The whole point of this exercise is to eliminate waste, not the value you deliver to your customers. Slashing costs should never mean using cheaper materials or rushing through jobs. That's a race to the bottom.

Instead, smart overhead reduction can actually improve your service quality. For example, when you automate administrative work like scheduling and invoicing, you free up your team’s time. They can now focus more on delivering exceptional client work, which directly enhances the customer experience.

Think about it: renegotiating with a vendor to get a lower price for the exact same insurance policy has zero negative impact on your output. The key is to constantly distinguish between essential investments and inefficient spending.

Always ask yourself this critical question: "Does this specific expense directly improve my client's outcome?" If the answer is no, it's a prime candidate for review.

How Often Should My Business Review Its Overhead Costs?

Reviewing your costs needs to be a regular business habit, not a one-time crisis response. Too many businesses only start looking at expenses when cash flow gets tight. By then, it’s often too late to make calm, strategic decisions.

I recommend a two-part rhythm for reviewing overhead:

- A Deep Annual Audit: At least once a year, conduct a comprehensive, deep-dive review just like the one we've outlined. This is where you question every line item and renegotiate major contracts.

- A Lighter Quarterly Check-in: Every three months, perform a quicker scan. Use this time to monitor your software subscriptions for "SaaS creep," check utility usage for any spikes, and scan vendor invoices for errors or surprise price changes.

Setting a recurring reminder in your calendar turns this into a routine. This discipline allows you to catch rising costs early, keeping your business financially agile and ready for anything.

Is It Better to Outsource Tasks or Hire a Part-Time Employee?

Ah, the classic dilemma. The right answer depends entirely on the nature of the task and your long-term business needs. There’s no single solution that fits every situation.

Outsourcing to a freelancer or a specialized agency is the ideal choice for project-based work that requires expert skills you don't need on a daily basis. Think of tasks like a complete website redesign, legal advice for a new contract, or a targeted digital advertising campaign. This approach gives you access to top-tier talent without the heavy overhead of a salaried employee.

On the other hand, hiring a part-time employee is generally better for ongoing, core operational tasks that require deep integration with your team and processes. This could include daily administrative support, routine customer service, or dispatching.

To make the right call, carefully evaluate the task's consistency, its required skill level, and how much it needs to be integrated into your daily workflow.

Ready to make a real dent in your overhead without sacrificing service quality? See how Marlie.ai can automate your customer calls, book jobs 24/7, and free up your time—all for a fraction of the cost of a traditional answering service. Discover the smarter way to manage your calls at Marlie.ai.