Cutting business expenses isn't about panicked, across-the-board slashes. It's about making deliberate, strategic decisions. The most effective path I've seen—and helped businesses walk—boils down to a proactive approach built on three core ideas: embracing the right technology, getting smarter about vendor relationships, and methodically auditing your operations. This isn't about starving your business; it's about building lasting financial intelligence.

Your Starting Point for Smarter Spending

Before you can trim a single dollar from your budget in a meaningful way, you need a painfully clear picture of where every dollar is going. So many businesses get stuck in a reactive loop, only scrutinizing costs when cash flow gets tight. But a truly effective strategy flips this script from short-term survival to building a more sustainable, profitable company. It's about weaving efficiency into the very fabric of your business.

From my own experience guiding companies through this process, the biggest wins always come from a structured approach. Instead of randomly chopping budgets and hoping for the best, we're going to create a simple roadmap to pinpoint the areas where you can make the biggest impact, fast.

The Three Pillars of Cost Reduction

This guide zeros in on three high-impact areas that consistently deliver the best results. Get these right, and you're not just cutting costs—you're building a foundation for long-term financial health.

- Technology and Automation: The right tools can instantly reclaim wasted hours and prevent expensive manual mistakes. You can explore this concept further in our in-depth guide on business process automation.

- Vendor and Supplier Management: Your contracts aren't set in stone. Regular audits and a bit of savvy negotiation can unlock surprising savings from the suppliers you already work with.

- Operational Overhead: All those "little" costs—software subscriptions, utilities, even underused office space—can quietly bleed your profits. A thorough review almost always reveals easy wins for leaner operations.

The real goal isn't just to spend less, but to spend smarter. Every dollar you save through better efficiency is a dollar you can pour back into growth, marketing, or developing your team. That's how you create a powerful cycle of success.

By focusing on these three pillars, you move beyond the simple act of cost-cutting and start building a more resilient and profitable business from the inside out. Let's start by digging into how you can put technology to work for your bottom line.

To give you a quick overview, here are some of the most effective areas to target right away. Think of this as your cheat sheet for immediate action.

High-Impact Areas for Cost Reduction

| Expense Category | Core Strategy | Primary Benefit |

|---|---|---|

| Call Handling | Automate routine calls & FAQs with AI voice agents | Frees up human staff for high-value tasks |

| Vendor Contracts | Renegotiate terms with long-standing suppliers | Lowers recurring costs without changing vendors |

| Software Subscriptions | Audit all SaaS tools for redundancy and non-use | Eliminates "zombie" costs for unused software |

| Operational Overhead | Review utilities, office space, and insurance policies | Reduces fixed costs that drain monthly profits |

| Marketing Spend | Focus on high-ROI channels based on data analysis | Maximizes customer acquisition per dollar spent |

| Employee Productivity | Use automation to handle repetitive administrative work | Increases output without increasing headcount |

Each of these categories represents a significant opportunity. You don't have to tackle them all at once, but starting with just one or two can create immediate momentum and free up cash flow.

Unlock Savings with Financial Technology

If you're still tracking expenses manually, you're fighting a losing battle. It’s not just that it’s slow and tedious—it's that you’re actively bleeding cash through wasted admin hours and compliance failures. Let's be honest: spreadsheets and shoeboxes full of receipts are relics that cost you real money.

I've seen it time and again: AI-powered expense management systems completely change the game. These platforms aren't just digital ledgers. They're intelligent tools that bring real clarity and control to your company's spending. You get a real-time view of your financial health, not month-end reports that are already ancient history by the time you see them.

This is a fundamental shift from being reactive to proactive. Technology becomes your single best ally in wrestling back financial control and figuring out how to genuinely reduce business expenses.

Automate and Enforce Your Expense Policies

One of the first things you'll notice with modern financial tech is how it automates policy enforcement. When humans review expenses, mistakes happen. Inconsistencies creep in. That leads to overspending and compliance headaches down the road. AI-driven systems stop this problem before it starts.

When an employee submits an expense, the system can instantly:

- Categorize Spending: Machine learning just handles it, categorizing transactions without anyone on your finance team lifting a finger. Think of all the hours that saves.

- Flag Out-of-Policy Expenses: The software immediately checks submissions against your company's rules. It flags anything over the limit, missing a receipt, or in an unapproved category.

- Prevent Fraudulent Claims: AI is also surprisingly good at sniffing out weird patterns. Things like duplicate receipts or someone expensing weekend travel for a Tuesday conference get flagged for review before any money goes out the door.

This isn't just a hunch. A staggering 71% of finance leaders say they struggle with expense compliance and fraud using old-school manual methods. That struggle is exactly why so many are moving to automated solutions for better cost control. You can dig into more of the data on expense management industry trends at Netsuite.com.

Free Up Your Team with AI Assistants

Beyond just crunching the numbers, technology can also field that constant flood of questions that drowns your finance department. Instead of your people answering the same things over and over—"What's the per diem in Dallas?" or "When are expense reports due?"—an AI assistant can give instant, accurate answers 24/7.

An AI-powered tool can handle all those routine employee queries. This frees up your skilled finance pros to focus on what really matters: strategic work like forecasting, budgeting, and deep analysis. It's a direct trade—less administrative churn, more strategic output.

Key Takeaway: Bringing in financial technology is about so much more than just scanning receipts. It's about building an intelligent, automated system that enforces your rules, heads off fraud, and gives your best people their time back.

The chart you see above isn't just a pretty picture. It shows a clear industry-wide move toward adopting this kind of tech for better financial control. This isn't some niche trend; it's a proven way businesses are streamlining how they operate and cutting out waste. When you make this move, you're not just modernizing. You're giving yourself a serious competitive edge through smarter financial management.

Master Your Vendor and Supplier Negotiations

Think about your vendor and supplier contracts for a moment. Most business owners treat them like a fixed utility bill—something you just have to pay. But they're not static documents; they're dynamic opportunities for savings.

If you learn how to approach them strategically, you can turn your supplier list into a surprising source of cash flow. This isn't about being confrontational. It's about building genuine partnerships where both sides win. After all, a long-term vendor would almost always rather give you a 5-10% discount than lose your business for good.

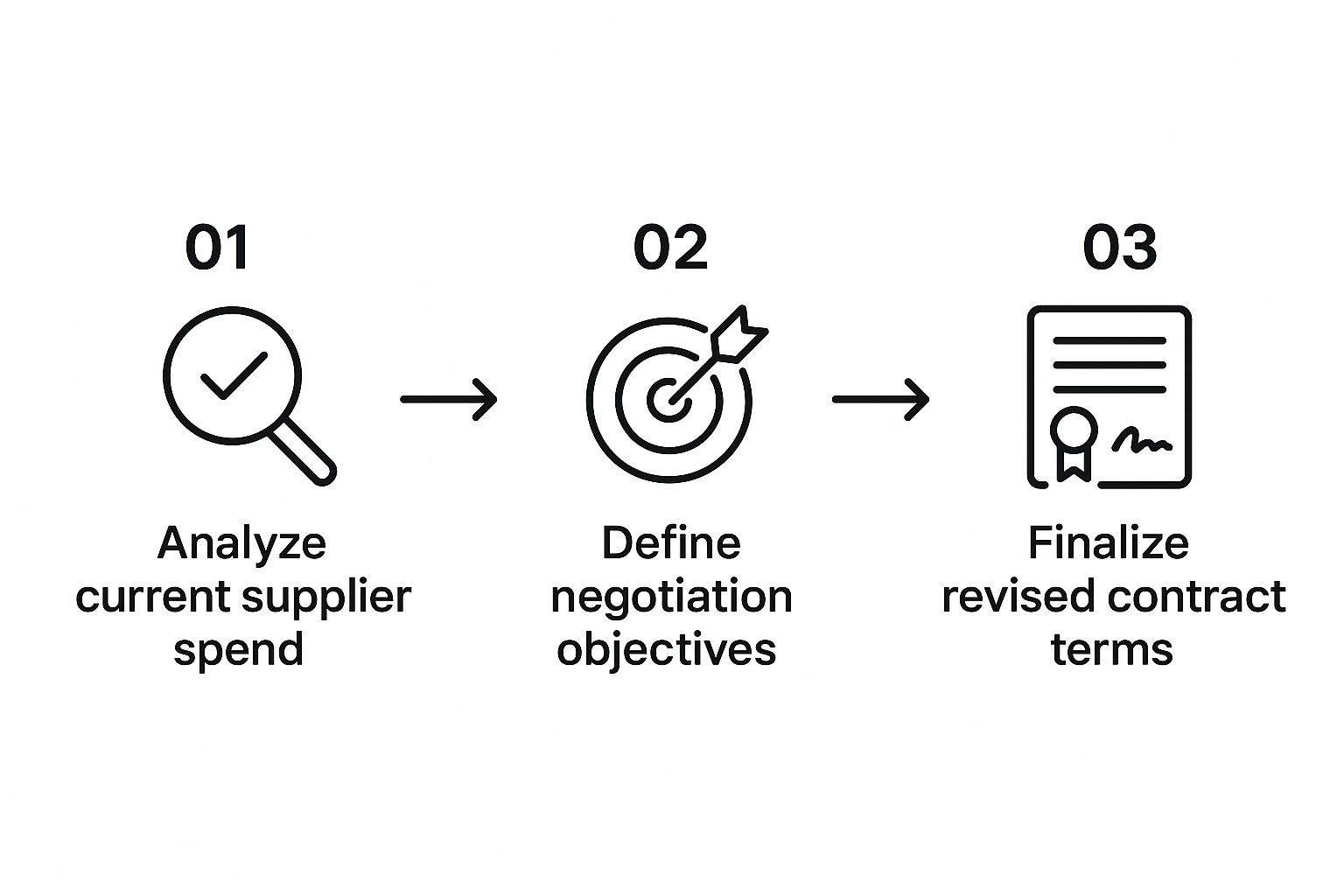

This simple flowchart lays out the core steps. It’s a cycle, not a one-off task.

The real takeaway here is that good negotiation is a process, not a random phone call. It starts with digging into the data and ends with a formal agreement, making sure your hard work actually translates into tangible savings.

Prepare for the Conversation

Before you even think about picking up the phone, you need to do your homework. This is what separates a successful negotiation from a wasted afternoon.

Start by benchmarking what you're paying against what the market is offering. A few quick searches for other providers will give you a powerful baseline to work from.

Then, arm yourself with specific data points:

- Your Spending History: Know the exact dollar amount you've spent with this vendor over the last year or two. Loyalty is a powerful bargaining chip.

- Competitor Pricing: Get quotes or find public pricing from at least two other suppliers. This isn't about bluffing; it's about showing you’ve done your research.

- Payment History: Are you a customer who always pays on time? That’s a huge asset. Don't be afraid to remind them of your excellent track record.

The most powerful position in any negotiation is being willing to walk away. When you have viable alternatives lined up, you’re not just asking for a discount—you’re making a sound business decision based on the best available offer.

Execute the Negotiation

When it comes time to talk, especially with a long-term partner, frame the conversation around partnership, not demands. I always start by saying how much I value their service and want to continue the relationship.

From there, you can explain that you're doing a regular budget review and looking at all major expenses. It's professional and non-confrontational.

Here are a few tactics I’ve used to steer the conversation in the right direction:

- Bundle Services: Ask if you can get a better rate by consolidating more of your business with them. Vendors love increasing their share of a customer's wallet.

- Negotiate Payment Terms: Sometimes cash flow is more important than the sticker price. See if you can switch from Net 30 to Net 60 terms, or if they’ll offer a 2% discount for paying early. It’s a win-win.

- Introduce Review Clauses: For new contracts, I try to add a clause that triggers an automatic rate review every 12 or 24 months. This makes future negotiations a standard part of doing business, not a confrontation.

This methodical approach respects the relationship you've built while still firmly protecting your bottom line.

Uncover Hidden Savings in Your Overhead

Overhead expenses are the silent profit killers. They aren't tied directly to a specific project or sale, so they have a nasty habit of flying under the radar. Costs like rent, utilities, and those never-ending software subscriptions can quietly balloon, eating away at your bottom line month after month.

If you’re serious about cutting business expenses, you have to get comfortable auditing these operational costs. This isn't about making painful, dramatic cuts. It’s about finding waste and simply making smarter choices. Let's walk through how to conduct a practical audit and find these hidden savings.

Confront the 'Zombie' Software Subscriptions

One of the fastest ways to hemorrhage cash is through "zombie" software subscriptions—accounts you pay for but no one actually uses. This is incredibly common, especially in growing companies. A team tries a new tool, it doesn't catch on, but the monthly charge lingers forever.

A systematic audit is the only way to stop the bleeding. Pull up your bank and credit card statements from the last quarter and go through them line by line.

- List every recurring software payment. Don't assume you know them all; you'll almost certainly be surprised.

- Assign each tool to its primary user or team. If you can't immediately name who depends on it, that's a huge red flag.

- Be ruthless. Sort each tool into 'essential,' 'useful-but-not-critical,' or 'unnecessary.' Cancel everything in that last category on the spot.

- Spot the redundancies. Paying for two project management platforms or three file-sharing services? Pick one, consolidate, and cut the rest.

The real goal isn't just a one-time purge. It's about building a system where every recurring expense has a clear owner and a proven purpose. That simple discipline is what prevents future waste.

Re-Evaluate Your Physical Footprint

In an age of hybrid and remote work, the traditional office has become one of the biggest question marks for overhead. What was once a non-negotiable expense might now be an oversized luxury. You have to ask honestly: is our current office space still a critical asset?

For countless service-based businesses, the answer is changing. Downsizing to a smaller, more flexible space—or even going fully remote—can slash your single largest fixed cost. And it's not just about rent. A smaller office means lower utility bills, cheaper cleaning services, and fewer supply costs.

This same thinking applies to other physical costs like corporate travel. Data from Booking.com shows that while business travel is still a major budget item, companies are getting much stricter with their policies to rein in spending. They’re setting clearer spending limits and using preferred vendors to lock in better rates. You can dig into the latest business travel trends on their site for more ideas.

Run a Simple Energy and Inventory Audit

Finally, don't ignore the smaller, consistent drains on your overhead. A basic energy audit can reveal some surprising savings. Switching to LED lighting, installing programmable thermostats, and making sure all equipment is powered down after hours are small changes that compound into big savings over time.

The same goes for physical inventory if you carry it. Those carrying costs add up fast. Excess stock ties up cash and racks up expenses in storage and insurance. Try to implement a "just-in-time" approach where possible, ordering materials closer to when you actually need them. This frees up cash and turns dormant assets back into working capital for your business.

Fine-Tune Your Marketing Spend for a Better ROI

Marketing is the engine that keeps your business growing, but it can’t be a black box of runaway expenses. The goal isn't just to spend money—it's to make every single dollar you spend work as hard as it possibly can. This isn't about slashing budgets indiscriminately; it’s about getting smarter.

It all starts with a brutal, honest audit of every single marketing channel you're using. You need to know which ones are actually bringing you valuable, qualified leads and which are just a slow drain on your bank account. I’ve seen countless businesses find new levels of profitability just by shifting their focus from expensive paid ads to more sustainable, long-term strategies like inbound marketing.

Put Your Money Where the ROI Is

Your first job is to figure out your customer acquisition cost (CAC) for each channel. How much are you shelling out on Google Ads to land one new customer? Now, how does that compare to what you’re spending on, say, content creation to get that same result?

The answer often comes as a shock. While paid ads give you that instant gratification, strategies like SEO and content marketing build powerful momentum over time, almost always leading to a much lower long-term CAC. Once you have these numbers in hand, you can start making moves based on data, not just gut feelings.

- Double down on what works. Pour more resources into the channels that are already giving you the best return.

- Hit pause on the losers. Temporarily cut spending on channels with a high CAC and weak lead quality. Don't be afraid to pull the plug.

- Test and refine. Use that newly freed-up budget to experiment. Try new creative angles or get more granular with your audience targeting in your proven channels.

This kind of rigorous analysis is non-negotiable. It’s why so many companies now rely on dedicated software to track their travel and marketing expenses. In fact, the market for these tools is expected to grow at a compound annual rate of 12.4% through 2027, which just goes to show how critical this level of financial oversight has become. You can dig into more trends in expense management on llcbuddy.com to see for yourself.

A Smarter Playbook for Paid Ads

Even when you're using paid channels, you can be way more efficient. The worst thing you can do is "set it and forget it." Your campaigns need constant attention and optimization.

Start with relentless A/B testing. Pit different headlines, images, and calls to action against each other to see what truly connects with your audience. Even a tiny lift in your click-through rate can slash your cost per lead.

And get laser-focused with your targeting. The more precisely you can define who sees your ads, the less money you’ll waste on clicks from people who were never going to buy anyway.

A Lesson from the Trenches: I've personally worked with businesses that managed to cut their ad spend by 30% while actually increasing their lead flow. How? By relentlessly refining their audience targeting and A/B testing their creative. The single most expensive ad is always the one shown to the wrong person.

Remember, sharp marketing and fantastic customer service are two sides of the same coin. A brilliant ad campaign that funnels people into a frustrating customer experience is just a sophisticated way to burn cash. Fine-tuning your marketing is a huge piece of your broader customer service improvement strategies.

Common Questions About Business Expense Reduction

Even with a clear strategy, cutting costs always brings up practical questions. As a business owner, you're in a constant balancing act between saving money and fueling growth. This section tackles the most common questions I hear from entrepreneurs who are trying to get a handle on their expenses without kneecapping their own progress.

Here are some straight answers to help you navigate those tricky decisions.

What Is the Fastest Way to Cut Costs Without Hurting Growth?

The quickest win, almost without fail, comes from a deep audit of your subscriptions and software. It's just a natural part of business to accumulate recurring charges for tools that become redundant, get forgotten about, or are simply underused by the team.

Comb through every line item on your bank and credit card statements from the last few months. Your mission is to tag every single recurring payment.

Then, you have to be merciless in how you categorize them:

- Essential: We can't live without this. It's critical for daily operations or making money.

- Useful-but-not-critical: This is helpful, but maybe there's a cheaper alternative, or another tool we already pay for could do its job.

- Unnecessary: This is outdated, nobody's using it, or it's completely redundant.

Cancel everything in the "unnecessary" pile immediately. It sounds simple, but this one move can often free up hundreds, sometimes thousands, of dollars every single month without touching your core operations or your growth engine.

How Can I Lower Employee Costs Without Layoffs?

Focus on operational efficiency and taking a hard look at your benefits packages. Layoffs should be the absolute last resort, never the first move.

Embracing a remote or hybrid work model, if it makes sense for your business, can slash expenses tied to a physical office. Think rent, daily utilities, and all those little office supplies that add up. For many companies, this is the single biggest non-payroll expense they can attack.

A better-trained team is a more efficient team. Investing in skills and automating repetitive tasks frees your people up for high-value work, which often reduces the need for future hires as your business scales.

Also, it's time to get forensic with your benefits package. You might be able to negotiate better rates with your current health insurance provider, especially if your team size has changed. It never, ever hurts to shop around and see if a new provider can offer similar benefits for less.

Should I Cut My Marketing Budget to Save Money?

Slashing your marketing budget to zero is one of the most common and damaging mistakes a business can make. It's a classic short-term fix that directly suffocates long-term growth. The real goal isn't to eliminate your marketing spend—it's to optimize it.

You need to shift your budget away from high-cost, low-return activities and pour it into more efficient, sustainable strategies. For many businesses, that means leaning more heavily into things like SEO and content marketing that build assets and value over time.

Dig into your data and figure out the customer acquisition cost (CAC) for every single channel you're using. Once you know which channels are bringing you profitable customers, you can double down on what works and cut what doesn't. This makes sure every marketing dollar you spend is actively pushing the business forward. For more answers to common business questions, you can check out our extensive FAQ page.

How Often Should I Review My Business Expenses?

You need to schedule a deep-dive review of all your major expenses at least quarterly. I'm talking about contracts, insurance, rent, and other big overhead items. Put a recurring event in your calendar so it actually gets done.

But some spending areas need a closer watch. Key supplier costs and digital ad spend, for example, should be monitored monthly. Market conditions, pricing, and performance can change in a heartbeat. A great deal from six months ago might be wildly uncompetitive today. This consistent rhythm is what prevents small cost leaks from turning into massive profit drains.

Ready to cut costs and capture every lead? Marlie Ai provides a 24/7 AI phone assistant that ensures you never miss a call, all for just $0.25 per minute. See how much you can save and grow by visiting https://www.marlie.ai.