When you think about cutting payroll costs, the first thing that probably comes to mind is cutting hours or, worse, cutting people. But that’s a painful, short-sighted approach. The real secret is to stop treating payroll as a simple expense line and start seeing it as your biggest opportunity for boosting efficiency.

This means a strategic shift in thinking. We're going to dive into a three-part framework: auditing your current spending, automating repetitive tasks, and optimizing your workforce schedules. By making these moves, you can turn payroll from a source of stress into a powerful tool for sustainable savings.

Rethinking Payroll: From Expense to Efficiency Driver

Let's be honest. For most service businesses, payroll feels like a massive, unavoidable drain. Watching that number leave your bank account every two weeks can be a gut punch. But what if you could reframe it? What if payroll wasn't just a cost, but your best lever for strategic growth?

This guide isn’t about the tired advice to just "cut back." We’re going to explore how to thoughtfully trim payroll by making your entire operation run smarter. The goal isn’t merely to spend less—it’s to get far more value from every single dollar you invest in your team.

From Cost Center to Growth Engine

Viewing payroll as a fixed, unchangeable cost traps you in a defensive mindset. A far more empowering way to look at it is as a dynamic investment in your company's output. When you optimize how you spend on payroll, you're not just saving cash. You're building a more resilient, competitive, and ultimately more profitable business.

This shift in perspective opens up a world of possibilities for cutting costs without hurting service quality or crushing team morale. We’ll focus on concrete, actionable strategies that target the real culprits—wasted time, effort, and resources—not just headcounts.

The core idea is simple but incredibly powerful: Stop looking for ways to just cut payroll and start hunting for opportunities to eliminate waste. True, sustainable cost reduction is a byproduct of great efficiency.

For most businesses, payroll is a huge slice of the pie, often eating up 15% to 30% of total company revenue. With numbers like that, even small tweaks can have an outsized impact on your bottom line. It's no wonder businesses are leaning into technology to find savings. Projections show that by 2025, 60% of organizations will use automation for payroll data collection to get these expenses under control. If you're curious about the bigger picture, this analysis of global payroll statistics is a great read.

To get us started, here’s a quick overview of the core strategies we'll be breaking down. Think of this as your roadmap for the practical steps ahead.

Core Strategies for Payroll Cost Reduction

| Strategy Area | Key Action | Primary Benefit |

|---|---|---|

| Spending Analysis | Conduct a deep-dive audit of all payroll-related expenses. | Identify hidden costs and areas of inefficiency. |

| Process Automation | Implement technology for repetitive administrative tasks. | Free up staff time for higher-value work. |

| Schedule Optimization | Align staffing levels with actual customer demand. | Eliminate overstaffing and reduce idle labor costs. |

| Strategic Outsourcing | Partner with specialized vendors for non-core functions. | Access expertise while converting fixed labor costs to variable ones. |

Each of these areas offers a chance to build a leaner, more effective operation. Throughout this guide, we'll unpack exactly how to put them into practice.

Uncovering Hidden Costs With a Payroll Audit

Before you can slash payroll costs, you have to play detective. You need a complete, data-backed picture of where every single labor dollar is going. A proper payroll audit isn't just about double-checking pay stubs; it’s about dissecting your spending to find the hidden leaks that are quietly draining your profits.

The process starts by pulling the right reports. Don't just glance at the total payroll number. You need to break it down to see the real story. I always tell business owners to analyze their labor costs by department, by specific employee roles, and even by project. This granular view is where you spot where the money is really going.

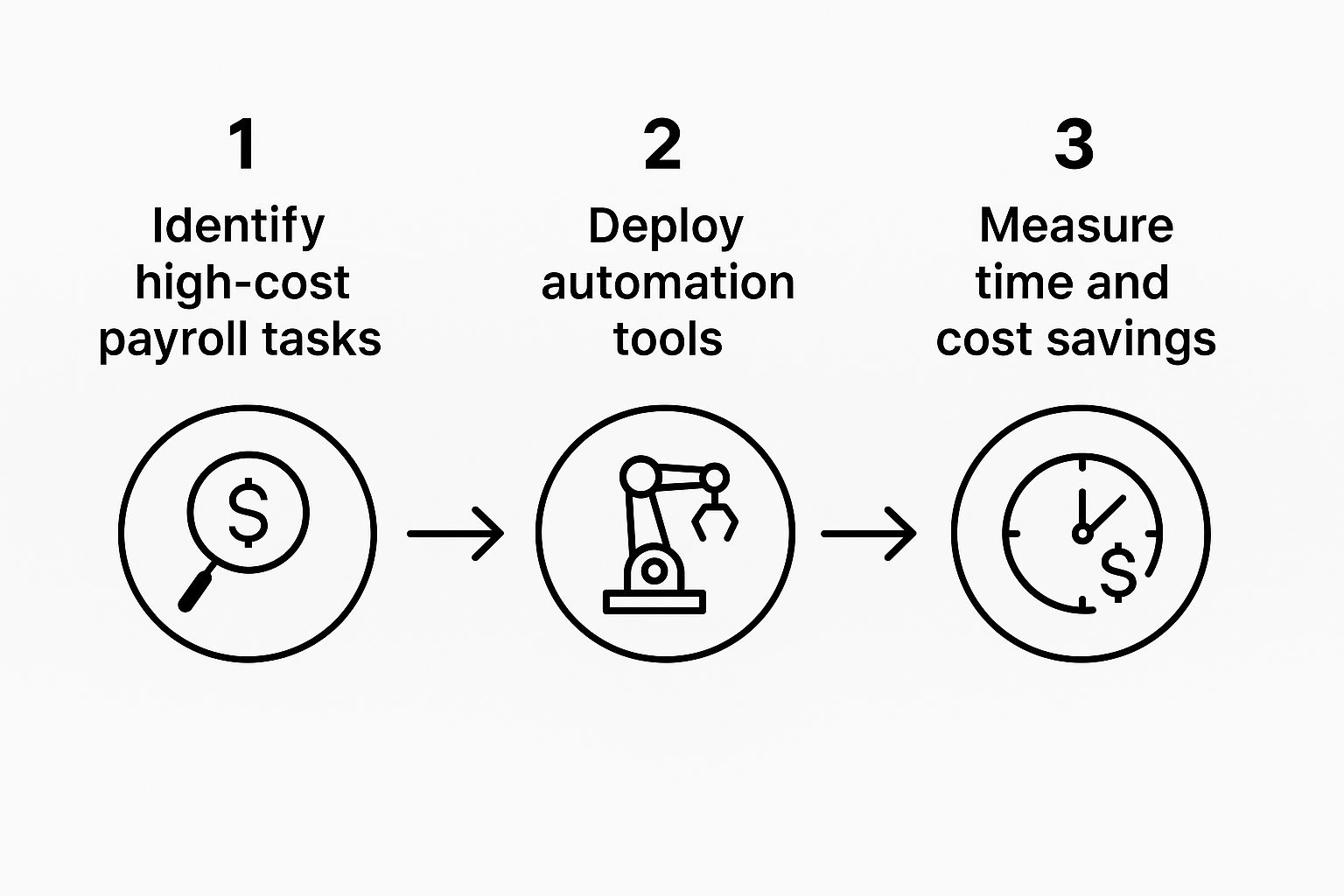

This is the exact, logical sequence I've used time and again to drive down costs.

The insight here is simple but powerful: real savings come from a logical flow. You identify the problem with data, apply a targeted fix like automation, and then measure the results to confirm it worked.

Key Metrics to Track in Your Audit

Your audit should zero in on the Key Performance Indicators (KPIs) that truly reveal the health of your payroll spending. Start by tracking these essentials:

- Labor Cost as a Percentage of Revenue: This is your north star metric. For most service businesses, a healthy range is somewhere between 20% and 35%. If you see that percentage creeping up, it’s a red flag that your labor costs are outgrowing your sales and you need to act fast.

- Overtime Hours vs. Regular Hours: Overtime is often the biggest hidden expense I find in a business's books. A consistent reliance on overtime almost always points to a deeper issue—maybe inefficient scheduling, understaffing in a key department, or even just poor task management.

- Cost Per Employee: You need to calculate the fully-loaded cost for each employee. This isn't just their wage. It includes payroll taxes, your share of benefits contributions, and any other associated overhead. This number gives you a much truer sense of what it costs to have someone on the team.

One of the most common—and costly—mistakes I see is misclassifying employees as exempt (salaried) when they legally should be non-exempt (hourly). This can blow up in your face with unexpected overtime liabilities and legal headaches. Your audit is the perfect time to review every employee's status and make sure you're compliant.

Ultimately, a payroll audit gives you the hard data you need to make smart, targeted decisions instead of just guessing. It’s the foundation for every other cost-cutting move you'll make. This data-first mindset is crucial for managing all your operational spending, and you can dive deeper into more strategies in our guide on how to reduce business expenses.

When you know your numbers inside and out, you can finally shift from reactive fire-fighting to proactive, strategic cost management.

Using Automation to Slash Payroll Expenses

Let's cut through the noise and talk about the tools that actually work to bring down payroll costs. Automation isn't some far-off concept anymore. It's a real, accessible strategy for any service business looking to trim the fat and get precious hours back.

The goal here isn't to replace your star employees. It's to get them off the hamster wheel of repetitive, low-impact tasks that suck up their time and your money. Instead of paying a person for manual data entry or to answer the same five questions a dozen times a day, you can hand those jobs to software for a fraction of the cost. This frees up your team to do the work that actually makes you money.

Practical Automation for Service Businesses

Think about the daily administrative grind in your business. How many hours are burned on tasks that could be done by a machine? Every single minute counts. For a service-based business, this is where automation delivers an almost immediate return.

Just look at these real-world examples:

- AI-Powered Call Assistants: If you run a plumbing or locksmith business, you know a missed call is a lost job. An AI assistant works 24/7 to answer every call, book appointments, grab customer details, and even process payments. You capture every single lead without footing the bill for a round-the-clock receptionist.

- Automated Scheduling Software: This is how you defeat the two biggest payroll killers: overstaffing and overtime. The software dives into your historical data and current demand to build smart schedules, making sure you aren't paying people to stand around during lulls.

- Integrated HR and Payroll Systems: Manual data entry is not only slow, it's a breeding ground for expensive mistakes. An integrated system syncs up employee hours, benefits, and tax info automatically. This slashes admin time and helps you dodge the compliance headaches that can turn into massive fines.

These aren't just tools for big corporations anymore. They're affordable, surprisingly easy to set up, and they pay for themselves by directly eliminating wasted labor hours.

The Financial Impact of Automation

The move to automation is more than just a passing trend; it’s a fundamental shift in how smart businesses manage their payroll. The big leaps in AI and automation are making operations smoother and far more accurate. The industry has really changed—automation now takes care of data input, validation, and tricky calculations, which means fewer manual errors and faster processing. If you want to dive deeper, we've broken down the key business process automation benefits in another guide.

Think about a local towing company that was shelling out thousands every month for an after-hours answering service. By swapping to an AI phone assistant, they didn't just save a ton of money—they saw a 20% jump in booked jobs because every call got picked up instantly and professionally. The tech paid for itself in less than a month.

This is a perfect example of how a smart tech investment can cut payroll while actually growing the business. You’re turning a fixed labor cost into a scalable, super-efficient tool. It’s clear that these systems are no longer optional for businesses that are serious about controlling costs.

Optimizing Schedules for a Flexible Workforce

Let's talk about scheduling. An overstaffed floor or an empty office during peak hours is a quiet but serious drain on your profits. Before you can get smart about payroll costs, you have to master workforce optimization. This isn't about just cutting hours wherever you can. It's about surgically aligning your staffing with actual customer demand.

The first step is to stop guessing and start using your own data.

Most service businesses have predictable rhythms—ebbs and flows you can almost set your watch to. A retail store, for example, can pull its point-of-sale data and see clear as day that Tuesday mornings are dead but Saturday afternoons are a madhouse. Building a schedule around these proven trends stops you from wasting money on overstaffing and, just as importantly, prevents you from getting caught shorthanded during a rush.

Strategic scheduling is one of the most direct levers you can pull to control expenses. When you match labor to demand, you're not just saving cash. You're making sure your team is deployed where they can make the biggest impact.

Embrace Flexible Staffing Models

Relying solely on a team of full-time, 9-to-5 employees is often an expensive and rigid way to run a business. A more modern—and much more cost-effective—approach is to build a blended, flexible team. This lets you scale your workforce up or down based on what's happening right now, turning a fixed labor cost into a variable one you can control.

Think about bringing in these alternatives to the traditional full-timer:

- Part-Time Specialists: Instead of hiring a full-time person for a role that truly only requires 20 hours of work a week, just bring on a dedicated part-timer. You get the exact skills you need without paying for idle time.

- Freelance or Contract Workers: For specific projects or those crazy seasonal spikes, freelancers are a lifesaver. You can bring in an expert for a defined period—like a marketing pro for a holiday campaign—without the long-term salary and overhead of a full-time hire.

- Compressed Workweeks: Offering options like a four-day, 40-hour workweek can be a massive morale booster. And happy, rested employees are often more productive and less likely to burn out, which indirectly cuts costs tied to turnover and calling in sick.

A landscaping company I know used to get slammed every spring, struggling with the unpredictable demand. They started building a reliable roster of on-call seasonal workers. Suddenly, they could handle a flood of new jobs without paying full-time wages during rainy weeks where nothing got done. This flexible model cut their spring payroll by over 15%.

Align Your Hours With Your Business Needs

Beyond who you staff, you need to take a hard look at when you're open for business. Your hours of operation should be a direct reflection of customer activity and profitability. It's simple math.

A coffee shop that stays open late but only serves a handful of people after 7 PM is almost certainly losing money on that late shift.

Dive into your sales data, hour by hour. Does it make financial sense to have a full morning crew on the clock if the revenue doesn't justify the labor cost? Trimming even one or two unprofitable hours each day can add up to thousands in savings over a year. This isn't about closing up shop early every day; it's about making sharp, data-driven decisions that strengthen your bottom line.

Making Smart Outsourcing Decisions

Sometimes, the smartest way to cut payroll is to realize the best person for the job isn't an employee at all. It's a fundamental shift in thinking. For a lot of service businesses, outsourcing non-core functions isn't just a tactic; it's a complete game-changer.

Think about it: you're converting a fixed, predictable labor cost into a flexible, variable expense. You can dial it up or down whenever you need to, which is a powerful lever to have.

Tasks like bookkeeping, IT support, or digital marketing are absolutely essential for your business to run, but they aren't what your customers pay you for. By handing these specialized duties off to a freelancer or an agency, you get expert-level talent without the hefty price tag of a full-time salary, benefits, and all the associated overhead.

Running the Numbers: In-House vs. Outsourced

Making a smart decision here comes down to a clear financial analysis. But it's not as simple as comparing a salary to an agency's fee. That's a rookie mistake. You have to calculate the fully-loaded cost of a new hire.

This goes way beyond their hourly wage or annual salary. It has to include every single associated expense that comes with having someone on your payroll:

- Payroll taxes (Social Security, Medicare, unemployment)

- Workers' compensation insurance

- Health insurance premiums and other benefits

- Retirement plan contributions

- Paid time off (vacation, sick days, holidays)

- Overhead like office space, new equipment, and software licenses

Once you have that total annual figure, you can compare it directly against the monthly or project-based fee of an outsourced provider. Often, the savings are immediately obvious, especially for specialized roles where you simply don't need 40 hours of work every single week.

For certain administrative tasks like answering calls, you can dig deeper into how this works by reading our guide on what is a virtual receptionist.

Managing Vendor Relationships for Maximum Value

Here’s the thing: outsourcing only saves you money if you manage it well. A cheap contract that delivers shoddy work or suddenly balloons with unexpected charges isn't a win. The real key is to avoid the common pitfalls that can quickly erase every penny you thought you were saving.

Hidden costs are a huge factor. One recent study found that 42% of payroll leaders ran into surprise costs when implementing new payroll solutions. Even more telling, 85% of decision-makers expect their global payroll spending per employee to go up in the next year. You can get more insights on these hidden payroll costs from Deel.com.

The success of your outsourcing strategy hinges on one word: clarity. You must define the scope of work with extreme precision from the very beginning. A vague contract is basically an open invitation for scope creep and extra fees.

To protect your bottom line, make sure your vendor agreement clearly spells out deliverables, timelines, and how you'll communicate. A well-defined partnership prevents misunderstandings and ensures you get exactly the quality and service you’re paying for. This kind of proactive management transforms outsourcing from a simple cost-cut into a genuine strategic advantage.

When you start thinking about cutting payroll, a lot of very real questions and concerns come bubbling to the surface. It’s only natural. Making changes to your team, schedules, and how you get work done can feel like walking on a tightrope.

Let's unpack some of the most common questions I hear from business owners. The goal here is to give you clear, practical answers so you can move forward with confidence, not guesswork.

Will This Wreck My Team's Morale?

This is a huge one, and for good reason. No one wants a mutiny on their hands. But here's the good news: reducing costs doesn't have to mean crushing morale—if you're smart about it.

The key is framing the changes around efficiency and working smarter, not just pinching pennies. When you bring in tools that kill off tedious tasks, or you offer flexible schedules that your team actually wants, you can genuinely boost morale. Your people feel less burnt out and see that you're building a stronger, more stable company for the long haul.

The secret ingredient here is transparent communication. You have to be open about why you're making these moves. Explain that the goal is to secure the company's future, which is a win for everyone. When your team understands the 'why,' they're a lot more likely to get on board with the 'how.'

What’s My Very First Move?

Before you even think about touching a schedule or demoing new software, your first move is always the same: a payroll audit. You simply can't fix what you don't fully understand.

This means you need to get your hands dirty and dive deep into your own data. You're looking for a crystal-clear picture of where every single labor dollar is going. Analyze your costs by department. Look for overtime trends. Compare your staffing levels to your actual busiest and slowest hours.

This data-first approach takes the guesswork out of it. It ensures you're targeting the biggest areas of waste instead of just making stabs in the dark.

How Do I Choose: Outsource or Hire?

This decision comes down to a cost-benefit analysis, but you have to look beyond the salary. Start by calculating the "fully loaded" cost of a new employee. That’s not just their paycheck—it’s their salary plus payroll taxes, benefits, training costs, and general overhead.

Once you have that real number, stack it up against the fee for a specialized contractor or agency.

- Outsourcing often wins for non-core, specialized tasks. Think IT support, bookkeeping, or digital marketing where you don't need someone for 40 hours a week.

- Hiring is usually better for roles that are central to your business—the core functions that your customers are actually paying you for.

Are There Legal Risks with Schedule Changes or Using Contractors?

Absolutely, and you need to tread carefully here. Labor laws are a minefield and vary wildly depending on where you operate.

When you adjust employee schedules, you have to follow every rule for things like overtime pay, mandatory meal breaks, and giving proper advance notice. And when you bring on freelancers, misclassifying them as independent contractors when they legally function as employees can bring down a world of hurt in the form of penalties and back taxes. A true contractor has to meet very specific legal tests for independence.

The stakes are high. It's always a smart move to consult with an HR pro or an employment lawyer before you make any major changes to your workforce.

Are you losing jobs and revenue because you can't answer every call? Marlie Ai is a 24/7 AI phone assistant that acts as your perfect receptionist, capturing every lead so you never miss an opportunity. It books jobs, takes messages, and answers questions instantly, saving you thousands in payroll while boosting your bottom line. See how it works.