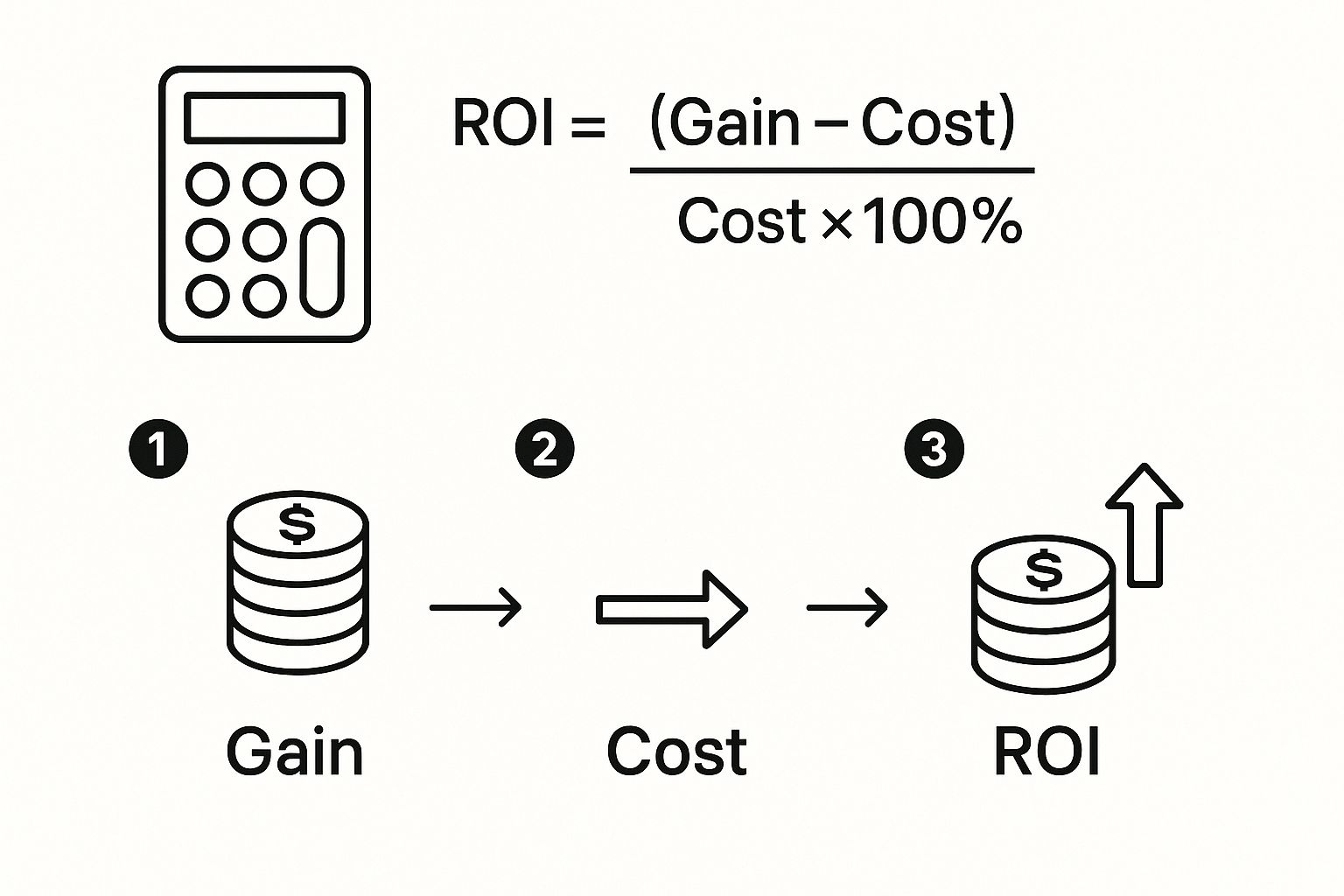

To figure out your ROI, you take the final value of an investment, subtract what you initially paid for it, and then divide that number by your original cost. Pop that into a percentage by multiplying by 100, and you’ve got your return on investment. It's a simple calculation that tells you how much bang you got for your buck. If you want to dive deeper, our detailed guide on how to calculate return on investment walks through more complex situations.

The Core ROI Formula

Return on Investment (ROI) is the universal language of business success. It tells a clear, simple story about whether an investment was profitable or not, cutting through all the noise to answer one question: Was it worth it?

By turning gains and costs into a straightforward percentage, ROI makes it easy to compare completely different types of investments—be it a marketing campaign, a new piece of equipment, or a stock purchase.

The standard formula is the financial world’s go-to metric for a reason: ROI (%) = ((Gain from Investment – Cost of Investment) / Cost of Investment) × 100.

Let's make this tangible. Say you invest $10,000 in stocks and pay $200 in brokerage fees. A year later, your stocks are worth $12,500, and you've also pocketed $300 in dividends.

Your ROI calculation would look like this: ((12,500 + 300 – 10,200) / 10,200) × 100, which comes out to 25%.

Key Takeaway: A positive ROI means you're in the black. A negative one means you've taken a loss. The higher that percentage, the better your investment performed relative to its initial cost.

Breaking Down the Components

To really nail this calculation, you have to be crystal clear on what goes into each part of the formula. "Gain from Investment" isn't just the final sale price; it's all the revenue or value generated. Similarly, the "Cost of Investment" needs to include every single expense you paid to get it.

Here’s a quick breakdown of what each component means in the real world.

Components of the ROI Formula Explained

| Component | Description | Example Value |

|---|---|---|

| Gain from Investment | This is the total value you received from the investment. It can be revenue, profit, or the final market value of an asset. | $12,800 |

| Cost of Investment | This includes all the money you spent to acquire and maintain the investment. Think purchase price, fees, taxes, and repairs. | $10,200 |

| Net Profit | The difference between your total gain and your total cost. This is the pure profit your investment generated. | $2,600 |

Getting these numbers right is the bedrock of a reliable ROI.

A solid grasp of managing overhead and profit is absolutely essential here. It helps you accurately define what counts as a 'cost' and a 'return.'

Without it, it's all too easy to make common mistakes, like forgetting about smaller fees or indirect costs. These oversights can artificially inflate your ROI, which might feel good at first but ultimately leads to flawed business decisions.

Putting The ROI Formula Into Practice

Let's get out of the textbook and into the real world. Theory is great, but seeing how the ROI formula works with an actual business scenario—like a digital marketing campaign—is where it all clicks. This is how you move from just knowing the formula to actually measuring the success of your work.

First things first, you have to get ruthlessly honest about your costs. This is where a lot of people trip up. They only count the obvious expenses and miss the hidden ones, which completely throws off the final number. For a marketing campaign, your investment is way more than just what you paid for the ads.

Here’s a more realistic breakdown of what you need to track:

- Ad Spend: The money paid directly to Google, Facebook, or wherever you're running ads. Let's say that’s $2,000.

- Creative Costs: Did you hire a designer or a copywriter? Pay for video production? Let's budget $500 for that.

- Staff Time: This is the big one people forget. If a team member who makes $50/hour spent 10 hours planning and managing the campaign, that’s another $500 you have to account for.

- Software/Tools: You also need to factor in a piece of your subscription costs for any marketing or analytics software you used. We'll estimate that at $100.

Add it all up, and our true Total Cost of Investment comes to $3,100.

This image breaks down the core formula we're about to use.

It’s pretty straightforward: take what you gained, subtract what you spent, and then divide that by your initial cost. Multiply by 100, and you’ve got your percentage.

Connecting Costs To Campaign Revenue

Now for the fun part—the money you made back. Let’s say this campaign brought in leads that turned into $8,500 in new sales revenue. That’s our Gain from Investment.

Now we have both sides of the equation and can plug them into the formula.

(Gain from Investment − Cost of Investment) ÷ Cost of Investment × 100%

($8,500 – $3,100) ÷ $3,100 × 100% = 174%

A 174% ROI is a fantastic result. It means that for every single dollar you put into this campaign, you got back $1.74 in pure profit.

Once you’ve got this process down, the next step is applying it to specific channels. Learning how to track your AdWords ROI, for example, allows you to get incredibly granular. This kind of detailed tracking gives you the hard data needed to justify your marketing budget and fine-tune your strategy for even bigger wins next time.

Accounting for Time with Annualized ROI

The basic ROI formula is a fantastic starting point, but it has one massive blind spot: time.

Think about it. A 20% return you nail down in six months looks exactly the same as a 20% return that took you five long years to achieve. That's a problem. This oversight can easily lead you to make some seriously flawed comparisons between different investment opportunities.

A quick win is almost always more valuable than a slow one. To really level the playing field, you need a smarter metric that factors in the holding period. This is where annualized ROI steps in. It’s all about standardizing your returns into an equivalent yearly figure, giving you a true apples-to-apples comparison.

This becomes absolutely critical when you're weighing investments that live in different worlds—like a short-term stock flip versus a long-term real estate play. Without annualization, you're just guessing. To dig deeper into this, check out how the time value of money impacts ROI comparisons on Salesforce.com.

The Annualized ROI Formula

Calculating annualized ROI might sound a bit intimidating at first, but it’s really just a logical next step from the basic formula. It simply converts the total return into an average annual rate, painting a much clearer picture of an investment's real performance over the years.

Here’s the formula you’ll use:

Annualized ROI = [(1 + ROI) ^ (1 / n)] – 1

Let's quickly break down what's going on here:

- ROI: This is your total return on investment, but expressed as a decimal. So, 25% becomes 0.25.

- n: This is the number of years you held the investment. If it's less than a year, 'n' will be a fraction (for example, six months is 0.5 years).

Let's walk through a real example. Say you invested $5,000 and cashed out three years later for $8,000. Your standard ROI is a solid 60% (or 0.60).

Now, let's plug that into our formula: [(1 + 0.60) ^ (1/3)] – 1. A quick calculation gives you 16.96%.

This tells you your investment didn't just grow by 60%; it grew at an average clip of nearly 17% each year. That annualized figure is infinitely more useful for comparing its performance against other opportunities, helping you make much smarter decisions with your money.

What a Good ROI Actually Looks Like

So you've crunched the numbers and have your ROI percentage. Now what? The honest answer is, that number doesn't mean much on its own.

A "good" ROI is completely relative. I've seen a 15% return be a massive win for one type of investment, but a total letdown for another. It all comes down to the industry you're in, the risk you took on, and how long you plan to wait for a payout.

Without that context, your ROI figure is just floating in space. To really understand what it's telling you, you need to compare it to a benchmark. This is how you figure out if you're outperforming the average or lagging behind.

Using the S&P 500 as a Benchmark

For a lot of investments, one of the best and most common benchmarks out there is the S&P 500 index. It tracks 500 of the biggest publicly-traded companies in the U.S., giving you a solid picture of the overall market's performance.

If you look at the historical data, the S&P 500 can be a real rollercoaster. Between 2015 and 2024, its annual returns swung from a gut-wrenching low of -18.1% to a high of 31.5%. But when you zoom out, the average annualized return over that decade shakes out to about 13.3%. For a deeper dive, the full historical returns data on Corporate Finance Institute is a great resource.

Practical Takeaway: If your investment pulled in a 10% ROI over a year, stacking it up against the S&P 500's average of 13.3% tells you it underperformed the market. On the other hand, hitting a 20% return means you did exceptionally well.

This kind of comparison is a simple gut check to see if the risk you took was actually worth the reward. It grounds your calculations in the real world. Spotting a high ROI in a specific venture is also a clear signal to double down and explore proven strategies for increasing business revenue in that area.

But a word of caution: ROI isn't the whole story. It famously ignores risk. A volatile stock that gets you a 25% ROI is a completely different beast than a stable real estate deal with the same return. Always look at ROI alongside other metrics to get a clear, balanced picture of how you're really doing.

Common Mistakes That Skew Your ROI

A simple miscalculation can turn a brilliant investment into a perceived failure—or worse, make a money pit look profitable. If you really want to know how to calculate ROI correctly, you have to sidestep the common pitfalls that can completely throw off your results.

One of the absolute biggest errors I see is underestimating the true cost of an investment. It’s so easy to just look at the sticker price, but that almost always gives you a dangerously inflated ROI.

Remember This: Your "Cost of Investment" has to include every single related expense. Forgetting these hidden costs is the fastest way to get a misleading number that will lead you to make poor business decisions down the line.

Overlooking Hidden Costs

When you’re tallying up your investment cost, you have to go beyond the obvious. Think about every single resource that was poured into the project. So many businesses completely forget to include essentials like:

- Labor and Staff Time: If your team sank 40 hours into a project, those hours have a real dollar value. They absolutely have to be counted.

- Overhead Expenses: You need to allocate a fair portion of your rent, utilities, and software subscriptions to the investment.

- Taxes and Fees: Things like transaction fees, sales tax, and other regulatory costs are all part of the total investment.

Forgetting these items will make your return look much higher than it really is. A great way to get a handle on this is to dig into strategies on how to reduce business expenses, which can help you spot these often-overlooked cost centers.

Another classic mistake is getting your revenue attribution wrong. This gets really tricky in marketing, where a customer might interact with your brand half a dozen times before they finally buy something. If you give all the credit to the very last click, you're ignoring the critical role that those earlier touchpoints played in the journey.

And finally, don't ignore the non-financial gains. These are harder to put a number on, but benefits like increased brand awareness, stronger customer loyalty, or new team skills are real returns that a basic ROI formula just can't capture on its own.

Common Questions About ROI (That You Were Afraid to Ask)

Even with the formula down pat, a few tricky questions always seem to surface. Let’s clear up some of the usual suspects so you can calculate ROI with total confidence.

What’s the Difference Between ROI and ROAS?

It’s easy to mix these two up, but they tell very different stories. ROAS, or Return on Ad Spend, is a pure marketing metric. It zooms in on one thing: how much gross revenue did you get back for every dollar you spent on a specific ad campaign?

ROI, on the other hand, pulls the camera way back. It looks at the bigger picture of net profit from an investment, and it accounts for all the costs involved. We’re talking ad spend, sure, but also your team’s salaries, the software you used, and any other overhead.

Think of it this way: ROAS tells you if your ads are working. ROI tells you if your business is actually making money.

A killer ROAS is great, but a positive ROI is what keeps the lights on. You can absolutely have a campaign with a fantastic ROAS that still results in a negative ROI once all the other business costs are factored in.

What if I Get a Negative ROI?

First off, don't panic. A negative ROI isn't a failure—it's feedback. It’s valuable data telling you that an investment cost you more than it brought in. Now you get to play detective.

Start by digging into the "why":

- Were your costs way too high? Take another look at your expenses. Did you miss something or is there a major inefficiency you can trim down?

- Did the return fall short? Maybe your revenue projections were a bit too optimistic, or the marketing strategy just didn't land the way you expected.

- Were there non-financial wins? Sometimes the goal isn't just immediate profit. A campaign might have generated huge brand awareness or valuable customer insights, which don't show up in the ROI calculation but still hold real value.

A negative ROI is just a signpost. Use it to learn, adjust your strategy, and make a smarter bet next time.

Never miss a customer call—or a dollar—again. Marlie Ai is a 24/7 AI phone assistant that books jobs, answers questions, and ensures every lead is captured, all for just $0.25 per minute. See how it works at https://www.marlie.ai.