Improving your profit margin isn't about finding one silver bullet. It's about a strategic mix of smarter pricing, disciplined cost management, and operational hustle. The best in the business master three things: raising prices to reflect true value, cutting costs without gutting quality, and boosting efficiency with the right tools.

The Real Path to Better Profit Margins

Profitability is the lifeblood of any business, but just chasing revenue won’t get you there. Real financial health is measured by your profit margin—the percentage of sales you actually pocket after all the bills are paid. Too many businesses fixate on top-line growth, bringing in more sales while completely ignoring the leaks draining profits from the bottom.

To really bump up your profit margins, you have to look beyond the surface-level numbers. It means taking a hard, honest look at everything from your pricing model to how your team spends its time. This guide cuts through the fluff and gets straight to the practical, actionable steps real businesses are using to not just survive, but thrive.

Core Pillars of Margin Improvement

When you boil it down, improving your margin comes down to pulling three key financial levers. Every single strategy we're about to cover ties back to one of these fundamentals:

- Pricing Strategy: This is more than just hiking up prices. It's about making sure what you charge actually lines up with the value you deliver, so you're not leaving cash on the table.

- Cost Management: Think of this as a surgical strike on your expenses. You're looking to trim both direct costs (Cost of Goods Sold) and the indirect operational expenses without ever compromising on quality or the customer experience.

- Operational Efficiency: This is the art of doing more with less. By optimizing workflows and embracing technology, you can serve more customers and generate more revenue without your costs ballooning proportionally. Every efficiency gain drops straight to your bottom line. A great place to start is figuring out https://www.marlie.ai/blog/how-to-calculate-roi on these initiatives.

"Profit margin is the ultimate report card for a business. It tells you not just how much you sold, but how well you sold it. A healthy margin is the clearest sign of a sustainable and well-run company."

A Strategic Overview

Beyond these core pillars, other critical factors come into play. One powerful, and often overlooked, path to boosting net profitability is implementing smart tax planning strategies for small businesses. The less you owe in taxes, the more of your hard-earned revenue you keep.

We’ll also dig into how using technology and adapting to market shifts are non-negotiables for building a more resilient business. This table gives you a quick snapshot of the core strategies we'll be unpacking in detail.

Core Strategies for Margin Improvement at a Glance

This table breaks down the main approaches to increasing profit margins covered in this guide. Think of it as a quick-reference cheat sheet for the key actions and goals behind each strategy.

| Strategy Area | Key Action | Primary Goal |

|---|---|---|

| Pricing Optimization | Adopt value-based pricing and tiered offerings. | Maximize revenue from each sale. |

| Cost Control | Audit COGS and operating expenses regularly. | Reduce cash outflow without losing quality. |

| Operational Efficiency | Automate repetitive tasks and streamline workflows. | Increase output with existing resources. |

| Revenue Growth | Focus on upselling and cross-selling to existing customers. | Boost customer lifetime value (LTV). |

Each of these areas offers a powerful way to strengthen your financial foundation. Now, let's dive into the specifics of how to put them into action.

Rethinking Your Pricing for Higher Profits

Your price isn't just a number. It's a powerful statement about the value you deliver, and frankly, it's one of the sharpest tools you have for boosting your bottom line.

Too many business owners get stuck in the "cost-plus" trap, where they just add a standard markup to their expenses. It's simple, sure, but it almost always leaves a significant amount of money on the table. Why? Because it completely ignores the single most important factor: what your service is actually worth to the customer.

To really nail your pricing, you have to shift your thinking from "How much does this cost me to deliver?" to "What problem am I solving for my customer, and what is that solution truly worth to them?" That's the heart of value-based pricing.

The Shift to Value-Based Pricing

Instead of tethering your prices to your own internal costs, value-based pricing anchors them to the perceived value you create. Think about it. A locksmith who gets you back in your house at 2 AM isn't just selling a few minutes of labor and a trip charge. They're selling immediate safety, relief from a stressful situation, and peace of mind. The value of that solution is miles beyond the cost of gas and a lockpick set.

To make this work, you have to get inside your customers' heads. What are their biggest headaches? How does your service make that pain go away? Once you have a crystal-clear understanding of that, you can set prices that capture a fair share of the value you're creating. This is how you can directly boost your profit margins without changing a single thing about your costs.

A price is a signal. It tells your customer what to expect. Pricing too low can signal a lack of confidence or quality, while pricing based on value communicates expertise and superior results.

Tiered Offerings and Bundles to Maximize Revenue

A single, one-size-fits-all price rarely fits anyone perfectly. This is where tiered pricing becomes a brilliant strategy for appealing to different customer segments with different needs and budgets.

Take a typical SaaS company, for example. They might offer:

- Basic Tier: A low-cost entry point with core features for solo entrepreneurs.

- Pro Tier: More advanced tools and collaboration features for growing teams, at a higher price.

- Enterprise Tier: A premium, custom-built solution with dedicated support and top-tier security for large organizations, priced accordingly.

This structure allows them to pull in revenue from a much wider slice of the market. The basic tier is great for customer acquisition, but the pro and enterprise tiers are where the real profit margin expansion happens.

This isn't just for software. A local HVAC company could bundle a discounted annual maintenance plan with a new AC installation. This increases the value of the initial sale and locks in future recurring revenue. This kind of strategic thinking is a core part of what's known as revenue optimization.

Using Economic Shifts to Your Advantage

Big-picture economic changes can create some surprising windows of opportunity for price adjustments. The post-pandemic economy is a perfect, if intense, example of how external factors can reshape profitability.

As inflation and supply chain chaos hit, the entire competitive landscape shifted. While U.S. prices rose by about 17% from the end of 2019, this jump actually outpaced labor and nonlabor costs for many larger firms. The result was a stunning 41% surge in corporate profits.

Supply chain bottlenecks limited competition, which allowed companies to pass on higher markups. While small businesses definitely face a different set of pressures, this trend shows that under certain market conditions, customers become more receptive to price changes, especially when the value is clear. You can dig deeper into these economic trends over at cadtm.org.

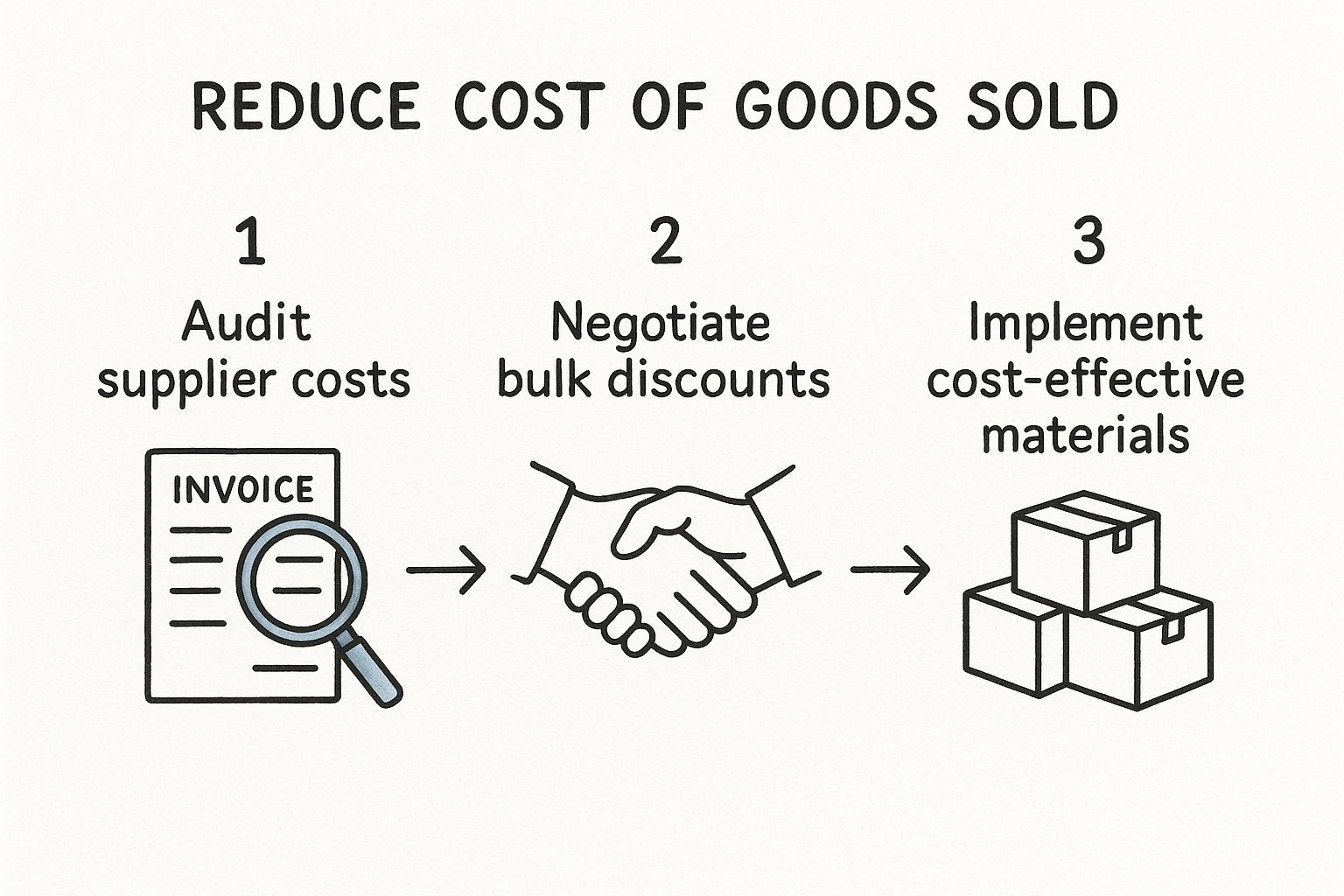

Before you adjust your own prices, though, you need a firm grip on your costs. The infographic below outlines a simple process for conducting a cost audit.

Running through this process—auditing supplier costs, negotiating better deals, and sourcing more efficient materials—can lower your cost of goods sold. That gives you much more breathing room and flexibility in your pricing strategy.

Communicating Price Changes Transparently

Let's be honest: raising prices can feel daunting. The secret to doing it without sending customers running for the hills is open, confident communication. People are far more understanding when they know why something is changing.

Never spring a price increase on your customers. Give them plenty of advance notice, especially for recurring services. And when you announce it, frame the change around the value they receive, not just your rising costs. For instance, explain that the adjustment allows you to invest in better equipment, offer faster service, or use higher-quality materials—all things that directly benefit them.

Tips for a Smooth Price Adjustment:

- Notify in Advance: Give existing customers at least 30-60 days' notice.

- Explain the "Why": Briefly connect the change to your commitment to quality and service improvements.

- Reinforce the Value: Gently remind them of the unique benefits they get from working with you.

- Offer Options: As a gesture of loyalty, consider grandfathering existing customers at the old rate for a limited time.

By rethinking your entire approach to pricing, you can stop leaving money on the table and start building a more resilient, profitable business that truly reflects the value you deliver.

Cutting Costs Without Compromising Quality

Boosting your profit margin isn't just about making more money—it’s about keeping more of the money you make. While smart pricing pushes your revenue up, sharp cost control is what protects your bottom line.

The trick is to think like a surgeon, not a butcher. You want to make precise cuts that eliminate waste without touching the muscle and bone of your business: your product quality and customer experience.

This whole process kicks off with a detailed audit of your expenses. You need to get brutally honest about what's a "must-have" versus a "nice-to-have" and spot the areas where spending has crept up without adding real value. Every single dollar you save drops directly to your profit margin.

Auditing Your Direct Costs

Your first stop should be your Cost of Goods Sold (COGS). These are all the direct costs tied to actually making your product or delivering your service. This is often where you'll find the biggest wins, because even a small percentage drop here can have a massive impact on your gross margin.

Understanding exactly what goes into your COGS is the first step toward getting a handle on these expenses and, ultimately, boosting your profitability.

Reviewing your COGS shouldn't be a once-a-year headache; it needs to be an active, ongoing process. Here’s how you can start making an impact right away:

- Renegotiate Supplier Contracts: Don't just roll over and accept price hikes from suppliers. Go into that conversation armed with data—your order volume, quotes from their competitors, everything. Even a 5% cut in material costs can seriously widen your margins.

- Explore Bulk Purchasing: If you’ve got the cash flow and the storage space, buying essential materials in larger quantities can unlock some pretty hefty discounts. Just be smart about it; you don’t want to tie up too much capital in inventory that just sits there.

- Optimize Inventory Management: Excess inventory is dead weight. It locks up your cash, racks up storage costs, and runs the risk of becoming obsolete. Look into an inventory management system to help you adopt a just-in-time (JIT) approach, ordering materials only when you need them.

Trimming Indirect Operating Expenses

Once you've tackled your direct costs, it's time to look at your overhead—all the indirect costs needed to keep the lights on. Things like rent, utilities, and software subscriptions can quietly chew through your net profit if you're not paying attention.

For a much deeper look into this, check out our guide on how to reduce overhead costs.

Slashing costs indiscriminately is a sign of panic. Strategic cost reduction is a sign of discipline. The goal isn't to spend less; it's to spend smarter.

One of the sneakiest culprits of bloated overhead these days is "SaaS sprawl." So many businesses sign up for multiple software tools that either do the same thing or are barely being used. Get in the habit of doing a monthly audit of all your subscriptions. Ask yourself:

- Is this tool absolutely critical for our core operations?

- Are we using all its features, or could a cheaper tool do the job?

- Do we already have another tool that can handle this?

You might be shocked to find you can save hundreds, or even thousands, of dollars just by canceling redundant software. It’s the lowest-hanging fruit and requires zero sacrifice in quality.

The Macro View of Profit Margins

On a bigger scale, the ability to manage costs has been a massive driver of economic growth. Over the last 25 years, steadily rising profit margins have been a huge engine for the stock market, especially in the U.S. This was partly because companies got better at managing labor costs, but they also benefited from lower corporate taxes and interest rates.

This historical context really drives home how powerful cost control is. While you can't control national tax policy or interest rates, you absolutely can control how efficiently you run your own shop. The same principles that work on a macro scale can be applied directly to your business today.

By surgically trimming the fat from both your COGS and your operating expenses, you free up cash that can be put to work—reinvested in marketing, product development, or training your team. This creates a powerful cycle where smart spending leads to higher profits, which in turn fuels even more strategic growth.

Boosting Efficiency with Smarter Operations

Once you've fine-tuned your pricing and cut unnecessary expenses, the next big opportunity for widening your profit margins is hiding in plain sight: your day-to-day operations. This is all about learning to get more done with the resources you already have. It isn’t about working harder; it's about working smarter, with a whole lot less friction.

The whole idea boils down to eliminating waste—wasted time, wasted effort, and wasted materials. Every single manual, repetitive task your team slogs through is a golden opportunity for automation. Every communication breakdown that leads to a costly mistake is a process gap just begging to be filled. Fixing these things creates a straight line to better profitability.

Embrace Automation for Repetitive Tasks

Every business has them: those low-value, high-frequency tasks that eat up a shocking amount of your team's day. I'm talking about things like manually plugging customer data into a CRM, sending out appointment reminders one by one, or answering the same five questions over and over again on the phone. These are the low-hanging fruit for automation.

Take a typical service business, for example. Just managing inbound calls can be a massive operational headache. An AI phone assistant can step in to handle all the routine calls for booking jobs or grabbing customer details, and it works 24/7. This simple move frees up your human staff to focus on solving complex problems or handling high-touch customer conversations that actually bring in money. Let technology do the predictable work so your people can handle the exceptional.

For a much deeper look at this, our guide on https://www.marlie.ai/blog/how-to-increase-business-efficiency is packed with practical strategies. At its core, a huge part of growing your margins is constantly learning how to improve operational efficiency with both tech and better processes.

Streamline Your Internal Workflows

How does work actually get done in your company? If you can't sketch out the process from start to finish, I guarantee you have bottlenecks that are silently draining your bank account. Streamlining your workflows just means creating a clear, repeatable system for every important activity in your business.

This is where a project management tool like Trello, Asana, or Jira can be a game-changer. It gives everyone a central place to see the status of a project, who's responsible for the next step, and when it's due. This kind of visibility instantly kills off those endless "what's the status?" email chains and the "wait, who was supposed to do that?" confusion.

Operational efficiency isn’t an expense; it’s an investment in scalability. Every process you streamline and every task you automate builds a stronger foundation for growth, allowing you to handle more business without your costs spiraling out of control.

A classic real-world scenario is a repair business where the technicians in the field and the dispatchers in the office are constantly out of sync. Bringing in a simple field service management app connects them in real-time. The tech can update job statuses from their phone, upload photos, and create an invoice on the spot, while the office has total visibility. This one change can slash administrative work and get you paid faster.

Invest in Your People Through Cross-Training

Technology is a fantastic tool, but your team will always be your greatest asset. One of the most powerful, low-cost ways to make your operations more flexible is cross-training. When your employees can step into multiple roles, your entire business becomes way more resilient.

Think about it: what happens if your primary scheduler gets sick and is out for a week? Does everything grind to a halt? Or can someone else jump in without missing a beat because they’ve been trained on the system? That kind of agility prevents delays and ensures your customer service never takes a hit.

Key Benefits of Cross-Training Employees:

- Increased Flexibility: You can cover absences and adapt to busy periods without the cost and hassle of hiring temporary staff.

- Improved Team Cohesion: When people understand what their colleagues do, they appreciate each other more. It builds a much more collaborative culture.

- Enhanced Employee Skills: Cross-training gives your team a path for growth, which is a huge boost for morale and retention.

Building smarter operations isn't a one-and-done project. It’s an ongoing mindset of always looking for a better way to work. By automating the mundane, refining your core processes, and empowering your team with new skills, you build a business that is not just more profitable, but also more scalable and ready for whatever comes next.

Squeeze More Juice from the Customers You Already Have

Everyone's obsessed with finding new customers, and sure, that's part of the growth puzzle. But the real money, the stuff that pads your profit margins, is often sitting right under your nose with the customers who already know and trust you.

Think about it. It can cost five times more to land a new customer than to keep an existing one. That makes your current customer base an absolute goldmine for potential profit.

The goal here is to increase your customer lifetime value (LTV)—that's the total amount you can expect to earn from a single customer over time. When you sell more to your happy, loyal fans, the marketing cost is practically zero. That means almost all of that new revenue goes straight to your bottom line.

Master the Art of the Upsell and Cross-Sell

Upselling and cross-selling are your two most direct paths to a higher LTV. This isn't about being a pushy salesperson; it's about anticipating what your customer really needs and offering something that makes their initial purchase even better.

-

Upselling means nudging a customer toward a better, higher-end version of what they're already buying. Imagine an appliance repair tech offering a replacement part that's a bit more expensive but comes with a longer warranty and better performance. The customer gets more value, and the company boosts its transaction value with a higher-margin item. It's a win-win.

-

Cross-selling is about suggesting related or complementary products. The classic example is an e-commerce recommendation engine. Someone adds a new grill to their cart, and the site instantly suggests high-margin add-ons like a grill cover, premium utensils, or specialty wood chips. This simple, often automated, move can massively increase the average order value.

For this to work, your suggestions have to feel helpful, not exploitative. The secret is to genuinely understand your customer’s goals and offer things that truly enhance their experience.

This whole approach is a cornerstone of any smart business growth strategy. If you want to dive deeper into this, our guide on how to increase business revenue is packed with more actionable ideas.

Add New, High-Margin Revenue Streams

Don't just sell more of what you already have. Look for opportunities to introduce new services or products that fit naturally with your core business, especially ones that carry higher profit margins.

A marketing agency that mainly handles social media management, for example, could introduce a premium analytics consulting package. This new offering leverages their existing expertise but is a high-value, low-overhead service that can command a premium price, directly beefing up their margins.

Or take a plumbing company. They could launch a preventative maintenance subscription. For a recurring monthly fee, they provide annual inspections and priority service. This creates a predictable, high-margin revenue stream while also building incredible customer loyalty and smoothing out the seasonal ups and downs of their business.

By focusing on the people who are already in your corner, you build a more stable, predictable, and profitable business. You turn one-off sales into long-term relationships, creating a powerful engine for sustainable growth.

Of course. Here is the rewritten section, crafted to sound like an experienced human expert.

Let’s Tackle Your Big Questions on Profit Margins

Once you start digging into these strategies, questions are going to pop up. That’s natural. Boosting your profitability is a marathon, not a sprint, and knowing how to handle the common roadblocks will keep you moving in the right direction.

Let's dive into the practical questions I hear all the time from business owners when they finally decide to get serious about their margins.

How Quickly Will I Actually See My Margins Go Up?

This is always the first question, and the honest-to-God answer is: it depends entirely on which lever you pull first. Some moves create an almost instant cash injection, while others are more of a long-term play for the financial health of your company.

Pricing changes almost always deliver the quickest wins.

Think about it: a modest price bump on your most popular service can fatten up your gross margin on the very next sale you make. Bundling complementary services together can immediately lift your average order value. You can literally make these changes this week and see a difference on next week's P&L. It's that direct.

Operational improvements, on the other hand, are a slow burn. Bringing in a new inventory management system or automating a clunky internal process takes time and money upfront. These moves are absolutely crucial for building a truly profitable, sustainable business, but you might not see the financial payoff for a few quarters.

The trick is to play both the short and the long game. Go for a quick win with a smart pricing move to build momentum and confidence. At the same time, start laying the groundwork for those deeper operational changes that will pay you back for years to come.

Okay, I'm Overwhelmed. Where Do I Even Start?

With so many options, it's easy to get paralyzed. My advice is always the same: start with a simple financial review to find the "low-hanging fruit." You're looking for the easiest changes that will give you the biggest bang for your buck, right now.

Don't overcomplicate this. Just print out your latest profit and loss statement and grab a highlighter. Look for two things: expenses that seem way too high, or costs that have quietly crept up over the past year.

Here are a few classic places to find quick wins:

- Software Graveyard: Do a fast audit of all your SaaS subscriptions. You will almost certainly find you're paying for tools your team hasn’t touched in months or services that do the same thing. A few clicks to cancel can save hundreds a month, instantly.

- Supplier Chats: Pick one of your main suppliers and get them on the phone to renegotiate. If your order volume has gone up since you signed the contract, you're in a perfect spot to ask for a better deal. They want to keep your business.

- Hidden Fees: Take a hard look at your bank and payment processing statements. Those little merchant fees add up. A single call to your provider—or a bit of shopping around—can often shave a surprising amount off your monthly costs.

Starting small does two things: it builds your confidence and it frees up cash. One small victory gives you the fuel you need to go after the bigger, more complex projects.

Should I Focus on Cutting Costs or Raising Prices?

This isn't an either/or question. The real answer is "both," but where you start depends entirely on your business.

If you run a business with high overhead and direct costs—think a restaurant or a manufacturing plant—you'll likely find your biggest wins in cost control. For these types of businesses, a 1% drop in the Cost of Goods Sold (COGS) often has a much bigger impact on the bottom line than a 1% price hike. Your first priority should be a ruthless audit of your supplier contracts and operational waste.

Now, flip that around. If you're a specialized consulting firm or a high-end service provider with a stellar reputation, you might be leaving money on the table. If your clients are consistently blown away by the results you deliver, your biggest opportunity probably lies in a strategic pricing review. In that case, raising your prices to match the immense value you provide is the fastest way to healthier margins.

Don't let missed calls drain your profits. Marlie Ai is the 24/7 AI phone assistant that ensures you capture every lead. Marlie books jobs, schedules appointments, and provides world-class service, so you can focus on running your business. Discover how Marlie can transform your profitability today.